The market and Stock J have the following probability distributions: a. Calculate the expected rates of return

Question:

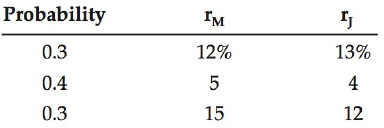

The market and Stock J have the following probability distributions:

a. Calculate the expected rates of return for the market and Stock J.

b. Calculate the standard deviations for the market and Stock J.

c. Calculate the coefficients of variation for the market and Stock J.

Transcribed Image Text:

Probability I'M 0.3 12% 13% 4 0.4 0.3 15 12

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

a r m 0312 045 0315 101 r j 0313 044 0...View the full answer

Answered By

Tobias sifuna

I am an individual who possesses a unique set of skills and qualities that make me well-suited for content and academic writing. I have a strong writing ability, allowing me to communicate ideas and arguments in a clear, concise, and effective manner. My writing is backed by extensive research skills, enabling me to gather information from credible sources to support my arguments. I also have critical thinking skills, which allow me to analyze information, draw informed conclusions, and present my arguments in a logical and convincing manner. Additionally, I have an eye for detail and the ability to carefully proofread my work, ensuring that it is free of errors and that all sources are properly cited. Time management skills are another key strength that allow me to meet deadlines and prioritize tasks effectively. Communication skills, including the ability to collaborate with others, including editors, peer reviewers, and subject matter experts, are also important qualities that I have. I am also adaptable, capable of writing on a variety of topics and adjusting my writing style and tone to meet the needs of different audiences and projects. Lastly, I am driven by a passion for writing, which continually drives me to improve my skills and produce high-quality work.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

Question Posted:

Students also viewed these Business questions

-

The following table shows the annual returns over time for two stocks. Calculate each stock's expected return, standard deviation, and coefficient of variation. Probability A B -10% 0.10 -3% 0.20 2...

-

You are given the following information on five stocks: The risk-free rate is 4% and the market risk premium is 5%. a. Which stocks are (a) undervalued, (b) overvalued, and (c) correctly valued? b....

-

The beta coefficient for Stock C is b C = 0.4, whereas that for Stock D is b D = - 0.3. (Stock D's beta is negative, indicating that its rate of return rises whenever returns on most other stocks...

-

The following are selected transactions of Bridgeport Department Store Ltd. for the current year ended December 31. Bridgeport is a private company operating in the province of Manitoba where PST is...

-

Explain the difference between time series data and cross-sectional data. Provide examples of each type of data.

-

The following selected information is available for the payroll computations of a company for the month of November 2021: Name of the Employee Gross Payroll for the month Elvira Robles Gloria...

-

True or False. Factor interactions are used to determine LO4 whether the factors affect the response separately.

-

Go to the books companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo, Inc. (a) What employee stock-option compensation...

-

Cypress Oil Company's December 3 1 , 2 0 2 4 , balance sheet listed $ 9 0 5 , 0 0 0 of notes receivable and $ 2 2 , 4 0 0 of interest receivable included in current assets. The following notes make...

-

A chemical processing firm is planning on adding a duplicate polyethylene plant at another location. The financial information for the first project year is shown in Table P2.2. (a) Compute the...

-

A stock's return has the following distribution: Calculate the stock's expected return, standard deviation, and coefficient of variation. Probability of This Demand Occurring Rate of Return if This...

-

Based on the information in Problem 7-7, if a portfolio is made up of 40% of stock A and 60% of stock B: a. Calculate the portfolio's expected rate of return. b. Calculate the portfolio's standard...

-

Refer to the data in Exercise 7-10. The company has decided to use the sequential method of allocation instead of the direct method. , Required: 1. Allocate the overhead costs to the producing...

-

6. A temporary pedestrian bridge is being designed in Bath for pedestrians to cross the river Avon. A contractor has been employed and the engineering company has decided to support the bridge using...

-

Write the constraints and find the solution for Crypt-arithmetic Problem in Al BASE +BALL B 7 A 4 S8 E 3 GAMES L5 G 1 M 9

-

A well stirred vessel of volume V initially contains fresh water. Dirty water of concentration C_0+cos(wt) (mass/volume) is fed to it at the rate of q (volume/time), where w is the frequency of...

-

In countries with high unemployment and poverty rates, the nation's people are often more concerned with the economic environment than the intricacies of its political systems. In 2010, Mohamed...

-

Analyze this approach: Consider that you could increase the productivity of your department, you have thought about certain ways to do it, but you are not sure. Your team has a lot of experience, but...

-

For the following exercises, consider this scenario: A town has an initial population of 75,000. It grows at a constant rate of 2,500 per year for 5 years. What is the output in the year 12 years...

-

In Exercises discuss the continuity of each function. f(x) -3 1 x - 4 y 3 2 -1 -2 -3+ 3 X

-

What should be the primary objective of managers?

-

Do firms have any responsibilities to society at large?

-

Is stock price maximization good or bad for society?

-

Aecerty 1067687 was completed with the folowing charaderistick Murulectere sec00 5xs:99 s35ida sputed

-

Assume todays settlement price on a CME EUR futures contract is $1.3180 per euro. You have a long position in one contract. EUR125,000 is the contract size of one EUR contract. Your performance bond...

-

Q2. Company ABC bought an equipment for $20,000 in 2015, with useful life of 5 years $5,000 residual value amortized using straight-line method. Prepare a table to illustrate the differences...

Study smarter with the SolutionInn App