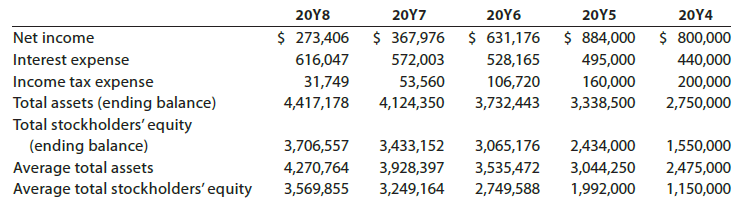

Addai Company has provided the following comparative information: You have been asked to evaluate the historical performance

Question:

Addai Company has provided the following comparative information:

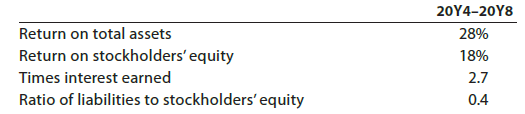

You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years:

Instructions

1. Prepare four line graphs with the ratio on the vertical axis and the years on the horizontal axis for the following four ratios (round to one decimal place):

a. Return on total assets

b. Return on stockholders’ equity

c. Times interest earned

d. Ratio of liabilities to stockholders’ equity

Display both the company ratio and the industry benchmark on each graph. That is, each graph should have two lines.

2. Prepare an analysis of the graphs in (1).

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton