Daisys Creamery Inc. is considering one of two investment options. Option 1 is a $75,000 investment in

Question:

Daisy’s Creamery Inc. is considering one of two investment options. Option 1 is a $75,000 investment in new blending equipment that is expected to produce equal annual cash flows of $19,000 for each of seven years. Option 2 is a $90,000 investment in a new computer system that is expected to produce equal annual cash flows of $27,000 for each of five years. The residual value of the blending equipment at the end of the fifth year is estimated to be $15,000. The computer system has no expected residual value at the end of the fifth year. Assume there is sufficient capital to fund only one of the projects. Determine which project should be selected, computing the (a) net present values and (b) present value indexes of the two projects. Assume a minimum rate of return of 10%. Round the present value index to two decimal places. Use the present value tables appearing in Exhibits 2 and 5 of this chapter.

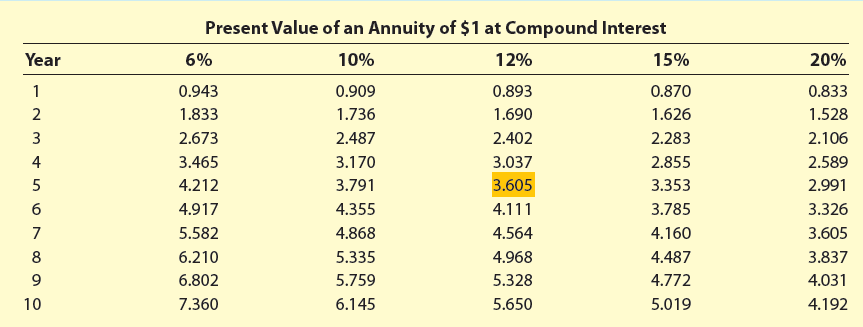

Exhibit 5:

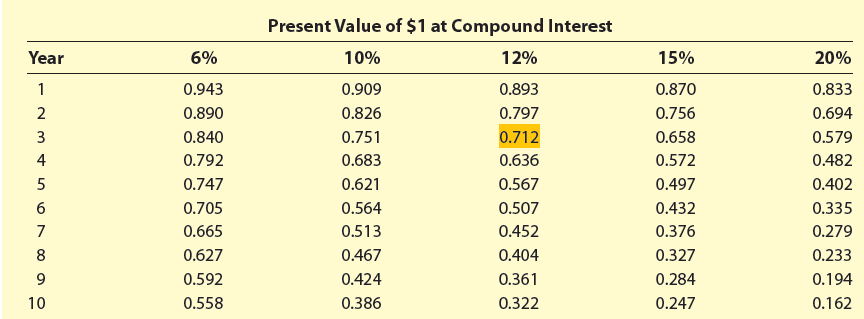

Exhibit 2:

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9781337119207

14th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac