Horton Technology has two divisions, Consumer and Commercial, and two corporate support departments, Tech Services and Purchasing.

Question:

Horton Technology has two divisions, Consumer and Commercial, and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows:

Tech Services Department...........................................................................$1,170,000

Purchasing Department.................................................................................450,000

Other corporate administrative expenses....................................................800,000

Total expense.................................................................................................$2,420,000

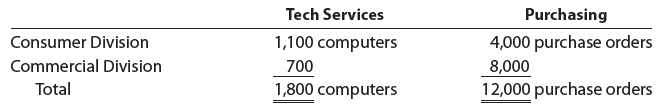

The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows:

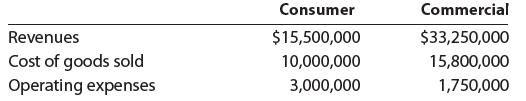

The support department allocations of the Tech Services Department and the Purchasing Department are considered controllable by the divisions. Corporate administrative expenses are not considered controllable by the divisions. The revenues, cost of goods sold, and operating expenses for the two divisions are as follows:

Prepare the divisional income statements for the two divisions.

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton