P 3. Bobbie Howell, the managing partner of the law firm Howell, Bagan, and Clark, LLP, makes

Question:

P 3. Bobbie Howell, the managing partner of the law firm Howell, Bagan, and Clark, LLP, makes asset acquisition and disposal decisions for the firm. As managing partner, she supervises the partners in charge of the firm’s three branch offices. Those partners have the authority to make employee compensation decisions.

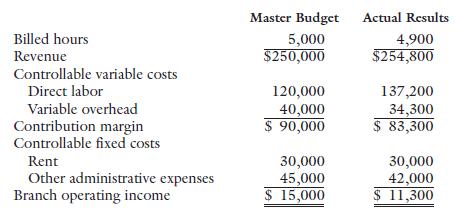

The partners’ compensation depends on the profitability of their branch office. Victoria Smith manages the City Branch, which has the following master budget and actual results for the year:

Required 1. Assume that the City Branch is a profit center. Prepare a performance report that includes a flexible budget. Determine the variances between actual results, the flexible budget, and the master budget.

Required 1. Assume that the City Branch is a profit center. Prepare a performance report that includes a flexible budget. Determine the variances between actual results, the flexible budget, and the master budget.

2. Evaluate Victoria Smith’s performance as manager of the City Branch.

3. Assume that the branch managers are assigned responsibility for capital expenditures and that the branches are thus investment centers. City Branch is expected to generate a desired ROI of at least 30 percent on average invested assets of $40,000.

a. Compute the branch’s return on investment and residual income.

b. Using the ROI and residual income, evaluate Victoria Smith’s performance as branch manager.

Step by Step Answer: