P 1. Beverage Products, LLC, manufactures metal beverage containers. The division that manufactures soft-drink beverage cans for

Question:

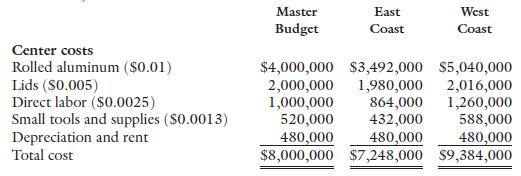

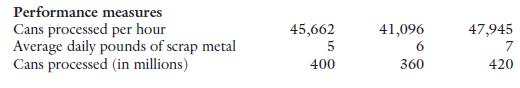

P 1. Beverage Products, LLC, manufactures metal beverage containers. The division that manufactures soft-drink beverage cans for the North American market has two plants that operate 24 hours a day, 365 days a year. The plants are evaluated as cost centers. Small tools and supplies are considered variable overhead.

Depreciation and rent are considered fixed overhead. The master budget for a plant and the operating results of the two North American plants, East Coast and West Coast, are as follows:

Required 1. Prepare a performance report for the East Coast plant. Include a flexible budget and variance analysis.

Required 1. Prepare a performance report for the East Coast plant. Include a flexible budget and variance analysis.

2. Prepare a performance report for the West Coast plant. Include a flexible budget and variance analysis.

3. Compare the two plants, and comment on their performance.

4. Explain why a flexible budget should be prepared.

Traditional and Variable Costing Income Statements

Step by Step Answer: