Value a risky corporate bond, assuming that the risk-free interest rate is 4 percent per period, where

Question:

Value a risky corporate bond, assuming that the risk-free interest rate is 4 percent per period, where a period is defined as six months. The corporate bond has a face value of $100 payable two periods from now and pays a 5 percent coupon per period; that is, interest payments of

$5 at the end of both the first period and the second period.

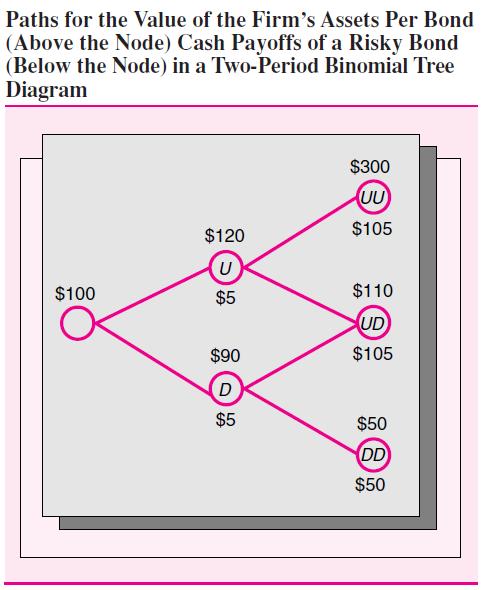

The corporate bond is a derivative of the assets of the issuing firm. Assume that the assets generate sufficient cash to pay off the promised coupon one period from now. In particular, the corporation has set aside a reserve fund of $5/1.04 per bond to pay off the promised coupon of the bond one period from now. Two periods from now, there are three possible states. In one of those states, the assets of the firm are not worth much and the firm defaults, unable to generate a sufficient amount of cash.

Only $50 of the $105 promised payment is made on the bond in this state. The exhibit below describes the value of the firm’s assets per bond (less the amount in the reserve fund maintained for the intermediate coupon) and the cash payoffs of the bond. The nonreserved assets of the firm are currently worth

$100 per bond. At the U and D nodes, the reserve fund has been depleted and the remaining assets of the firm per bond are worth $120 and $90, respectively, while they are worth $300, $110, and

$50, respectively, in the UU, UD, and DD states two periods from now.AppendixLO1

Step by Step Answer:

Financial Markets And Corporate Strategy

ISBN: 9780077119027

1st Edition

Authors: David Hillier, Mark Grinblatt, Sheridan Titman