11. Suppose we have the following information for two assets, 1 and 2: a. What is the...

Question:

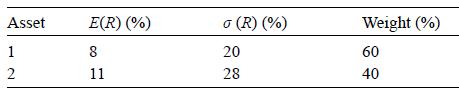

11. Suppose we have the following information for two assets, 1 and 2:

a. What is the portfolio variance and standard deviation if the correlation between the two assets is −1?

b. What is the portfolio variance and standard deviation if the correlation between the two assets is 0?

c. What is the portfolio variance and standard deviation if the correlation between the two assets is 1?

d. Comment on what happens to the portfolio standard deviation as the correlation increases from −1 to 1.

e. What is the portfolio expected return if the correlation between the two assets is −1, 0, or 1?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Global Financial Markets And Institutions

ISBN: 9780262039543

5th Edition

Authors: Frank J. Fabozzi, Frank J. Jones, Francesco A. Fabozzi, Steven V. Mann

Question Posted: