Let us consider again an annual percentage rate of (5 %). If we invest ($ 1000), with

Question:

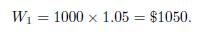

Let us consider again an annual percentage rate of \(5 \%\). If we invest \(\$ 1000\), with no compounding, wealth after one year is

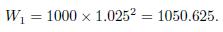

Now, what if interest is earned semiannually? The typical convention is that if the annual rate \(\mathrm{APR}_{2}\) is compounded semiannually, it means that a rate  applies to each semester. Hence,

applies to each semester. Hence,

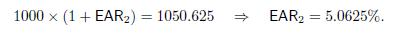

While the quoted rate \(\mathrm{APR}_{2}\) is \(5 \%\), the equivalent effective annual rate \(\mathrm{EAR}_{2}\), with semiannual compounding, is a bit larger and can be found as follows:

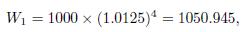

By a similar token, with quarterly compounding we find

which corresponds to an effective annual rate

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: