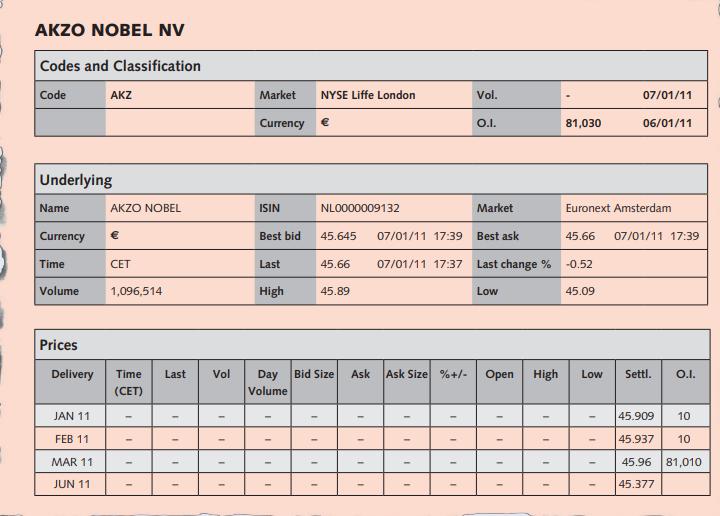

The bid and offer prices for single stock futures in Akzo Nobel are shown in Exhibit 10.12.

Question:

The bid and offer prices for single stock futures in Akzo Nobel are shown in Exhibit 10.12.

Exhibit 10.12 Single stock future prices for Akzo Nobel on 7 January 2011

Each future is for 100 shares and is cash settled. Prices quoted by market makers are in euros per share. Shares are selling on the spot market for €45.65.

You own 50,000 shares in Akzo Nobel, but you are not sure about the company’s prospects. On the one hand as Europe emerges from recession, demand for Akzo Nobel’s products will rise, leading to good share returns. On the other, Europe could have a second downturn and so Akzo Nobel’s shares will plummet. You estimate that the uncertainty will be lifted by 11 March 2011.

(a) Describe a hedging strategy you could employ to reduce price uncertainty between now (7 January 2011) and 11 March 2011.

(b) Show the gain/losses on underlying and derivative transaction if the share price on 11 March is €50.

(c) Show the gain/losses on underlying and derivative transaction if the share price on 11

March is €40.

Step by Step Answer: