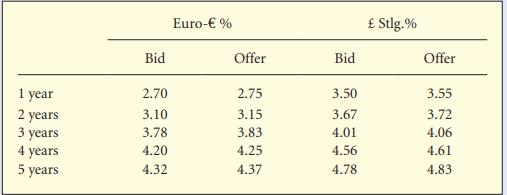

The current interest swap rates quoted by dealers are shown in the table Your firm currently has

Question:

The current interest swap rates quoted by dealers are shown in the table

Your firm currently has a €400 million five-year floating rate loan obligation paying 230 basis points over LIBOR. Currently, euro three-month LIBOR stands at 2.60 per cent. It also has a four-year £230 million fixed rate loan at 6.2 per cent per annum.

It would suit its cash flows and risk profile better if the euro loan was swapped into a fixed rate obligation and the sterling obligation was swapped into a floating rate obligation. Describe how the company could achieve these objectives using the prices quoted in the table which have been obtained from swap market intermediaries.

Note: the rates in the table are for AAA rated banks; your firm will have to pay 20 basis points over these rates given its greater counterparty risk.

Step by Step Answer: