The following example is taken from [4, Chapter 6]. Consider three assets with expected returns, standard deviations,

Question:

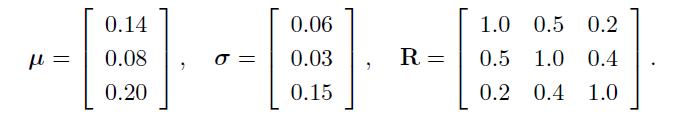

The following example is taken from [4, Chapter 6]. Consider three assets with expected returns, standard deviations, and correlation matrix given by:

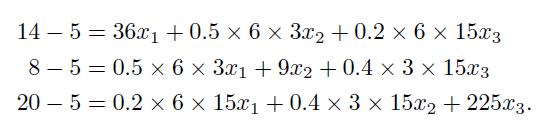

Assume further that the risk-free return is 5\%. Then, we should solve the following system of linear equations.There is an inconsistency, as returns have been multiplied by 100 and covariances by  , but this is inconsequential Why?

, but this is inconsequential Why?

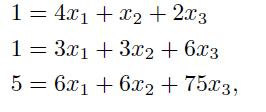

The system can be simplified to

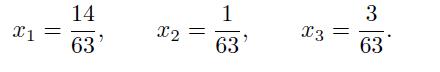

whose solution is

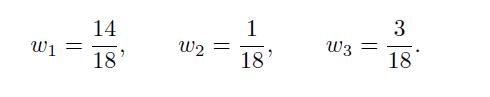

The sum of the three variables is 18/63. Dividing the pseudoweights by this normalization factor, we get the actual portfolio weights

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: