Cardinal Health, Inc., an Ohio corporation formed in 1979, is a leading provider of products and services

Question:

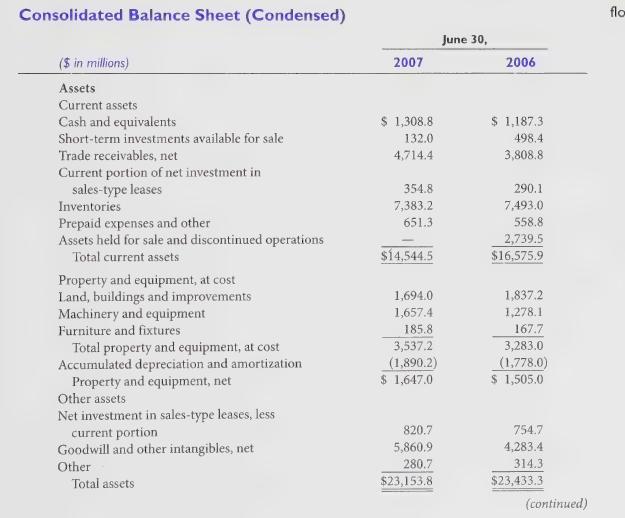

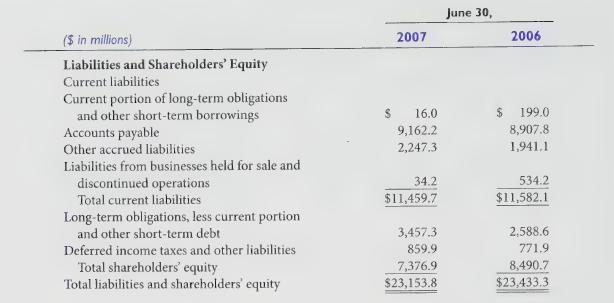

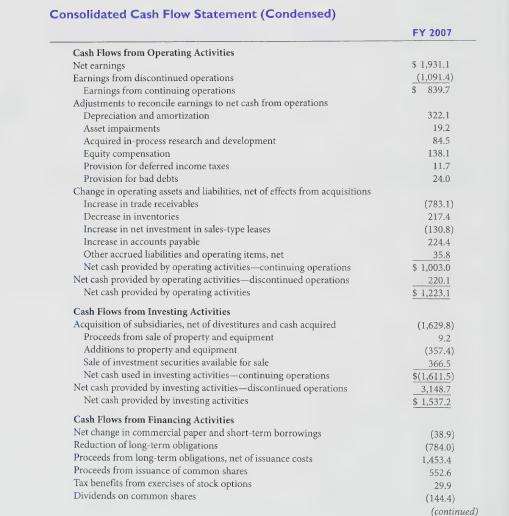

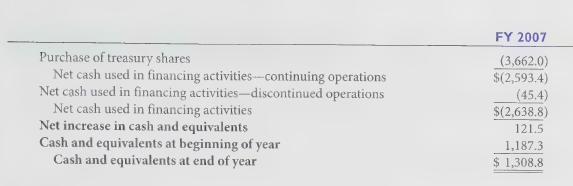

Cardinal Health, Inc., an Ohio corporation formed in 1979, is a leading provider of products and services that improve health care safety and productivity. The following edited balance sheet and cash flow statement are from the company's fiscal 2007 annual report.

Required:

1. For the following working capital accounts, calculate the changes that occurred during fiscal 2007:

• Short-term investments available for sale.

• Trade receivables.

• Inventories.

• Prepaid expenses and other.

• Current portion of long-term obligations and other short-term borrowings.

• Accounts payable.

• Other accrued liabilities.

Compare these changes to the accrual adjustments and other information found on Cardinal's cash flow statement and note any differences. Reconcile these differences if possible. (Hint: Retrieve Cardinal’s fiscal 2007 Form 10-K from the SEC’s Web site; information in the financial statement footnotes may help identify reconciling differences.)

http://www.sec.gov/Ar13c7 h1/i00v00e95s01/52e07d00g71a07r/1/27d62a4ate1a0v/k.7ht2m.

2. Investments in sales-type leases are listed among both the Current Assets and Other Assets sections. Calculate the changes that occurred in these line items during 2007, and reconcile these changes to the related item on the cash flow statement.

3. Calculate the changes in the property and equipment accounts and compare them to the related items in the Investing Activities section of the cash flow statement. (Hint: Perform a T-account analysis of Property and equipment and Accumulated depreciation, beginning with the latter.) To the extent possible, recreate the summary journal entries that Cardinal made to record asset retirements and acquisitions. Note any changes in Property and equipment that remain unexplained.

4. Refer to footnote 2 in Cardinal’s 2007 financial statements. Recreate the journal entry to record the acquisitions that took place during 2007 taking into consideration the Acquisition of subsidiaries item that appears in cash flows from investing activities. Assume that any previously unidentified additions to property and equipment and the unexplained changes in operating assets and liabilities (from requirements | and 3, respectively) —which appear on the cash flow statement net of effects from acquisitions—relate to the acquisitions referred to in footnote 2.

5. Refer to footnote 8 in Cardinal’s 2007 financial statements. To reconcile the changes in balance sheet line items related to Held for sale and Discontinued operations with the corresponding items on the cash flow statement, recreate Cardinal’s summary journal entry to record the disposal of these assets and liabilities.

Suggest possible reasons for

(a) the differences between changes in balance sheet accounts over the course of a fiscal year and related items on the cash flow statement and

(b) any of these differences that could not be reconciled. Support your answers.

Step by Step Answer: