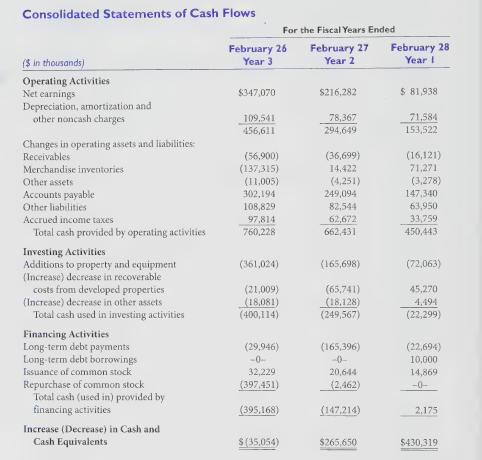

What follows are the consolidated statements of cash flows of Best Buy Company, Inc. The information provided

Question:

What follows are the consolidated statements of cash flows of Best Buy Company, Inc. The information provided in the annual report has been combined and abbreviated.

The following data are based on information provided by the company in its SEC filings:

Best Buy Co., Inc. is the nation’s largest volume specialty retailer of name-brand consumer electronic, home office equipment, entertainment software, and appliances. Part of the Company’s strategy is to provide a selection of brand name products comparable to retailers that specialize in the Company's principal product categories and seeks to ensure a high level of product availability for customers. The number of stores operated by the company increased from 272 at the end of Year 0, to 284, 311, and 357 at the end of Year 1, Year 2, and Year 3, respectively.

When entering a major metropolitan market, the Company establishes a district office, service center, and major appliance warehouse. Each new store requires working capital of approximately \($4\) million for merchandise inventory (net of vendor financing), leasehold improvements, fixtures, and equipment. Preopening costs of approximately \($600,000\) per store are incurred through hiring, relocating and training new employees, and in merchandising the store. These costs are expensed as incurred.

Required:

1. Using information provided in the cash flow statement, compare Best Buy’s earnings and cash flows from operations for the last three years and provide an explanation for the differences between these two numbers within each year and from year to year. Explain whether earning or operating cash flows provide a better indication of Best Buy’s performance.

2. How have new store openings affected Best Buy’s working capital needs over the last three years? Compare the company’s actual changes in working capital to the working capital needed to support new store openings and comment on any differences.

3. Comment on the year-to-year changes in inventories for the last three years and how these changes have been financed.

4. Comment on any insights gained from an analysis of the Investing and Financing section of Best Buy’s cash flow statement.

Step by Step Answer: