ESCO Technologies Inc. and Take-Two Interactive Software, Inc. both capitalize software development costs in accordance with their

Question:

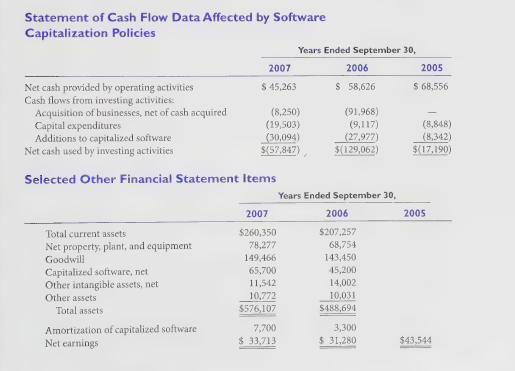

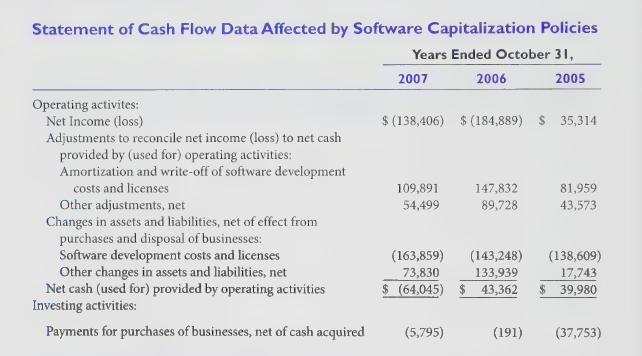

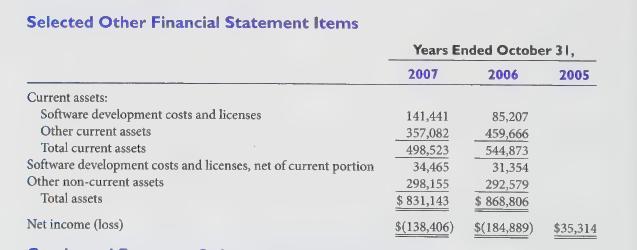

ESCO Technologies Inc. and Take-Two Interactive Software, Inc. both capitalize software development costs in accordance with their respective policies as summarized here. The condensed financial information that follows was extracted from each company’s fiscal 2007 Form 10-K (all dollars are in thousands). Full financial statements for each company may be accessed at www.sec.gov.

ESCO Technologies Inc.

ESCO Technologies Inc. and its wholly owned subsidiaries are organized into three reporting units:

Communications, Filtration/Fluid Flow, and RF Shielding and Test. The Communications unit is a proven supplier of special purpose fixed network communications systems for electric, gas, and water utilities, including hardware and software to support advanced metering applications. The Filtration unit develops, manufactures, and markets a broad range of filtration products used in the purification and processing of liquids. The Test unit provides its customers with the ability to identify, measure, and contain magnetic, electromagnetic, and acoustic energy.

Condensed Footnote: Capitalized Software The costs incurred for the development of computer software that will be sold, leased, or otherwise marketed are charged to expense when incurred as research and development until technological feasibility has been established for the product. Technological feasibility is typically established upon completion of a detailed program design. Costs incurred after this point are capitalized on a project-by-project basis in accordance with SFAS No. 86. Costs that are capitalized primarily consist of external development costs.

Upon general release of the product to customers, the Company ceases capitalization and . . . amortizes the software development costs over a three- to seven-year period based upon the estimated future economic life of the product.

Take-Two Interactive Software, Inc.

Take-Two Interactive Software, Inc. is a global publisher, developer, and distributor of interactive entertainment software, hardware, and accessories. Its publishing segment develops, markets, and publishes software titles for leading gaming and entertainment hardware platforms.

Condensed Footnote: Software Development Costs We utilize both internal development teams and third party software developers to develop the titles we publish.

We capitalize internal software development costs (including stock-based compensation, specifically identifiable employee payroll expense, and incentive compensation costs related to the completion and release of titles), third party production and other content costs, subsequent to establishing technological feasibility of a software title. Technological feasibility of a product includes the completion of both technical design documentation and game design documentation. Amortization of such capitalized costs is recorded on a title-by-title basis in cost of goods sold (software development costs) using (1) the proportion of current year revenues to the total revenues expected to be recorded over the life of the title or (2) the straight-line method over the remaining estimated useful life of the title, whichever is greater.

We frequently enter into agreements with third party developers that require us to make advance payments for game development and production services . ... We capitalize all advance payments to developers as software development. On a product-by-product basis, we reduce software development costs and record a corresponding amount of research and development expense for any costs incurred by third party developers prior to establishing technological feasibility of a product. We typically enter into agreements with third party developers after completing the technical design documentation for our products and therefore record the design costs leading up to a signed developer contract as research and development expense. We also generally contract with third party developers that have proven technology and experience in the genre of the software being developed, which often allows for the establishment of technological feasibility early in the development cycle. In instances where the documentation of the design and technology are not in place prior to an executed contract, we monitor the software development process and require our third party developers to adhere to the same technological feasibility standards that apply to our internally developed products.

Prior to establishing technological feasibility, we expense research and development costs as incurred.

Required:

1. Make any needed adjustment to Take-Twoss statement of cash flows to improve interfirm comparability of its operating cash flows.

2. Make any needed adjustment to ESCO Technologies’ statement of cash flows to improve interfirm comparability of its operating cash flows.

3. What is the likely impact of any adjustment(s) you made in requirements | and 2 on an analysis of operating cash flows?

4, What impact do ESCO’s software capitalization policies have on the company’s net income as reported for fiscal 2007? (Hint: Compare to income assuming that ESCO expenses all software development costs when incurred. Ignore income taxes.)

5. Compare Take-Two's and ESCO Technologies’ policies with respect to establishing technological feasibility and comment on the impact of these policies on reported net income.

6. Re-create summary journal entries for the fiscal 2007 activity in Take-Two's Software development costs and licenses account. Do your entries reconcile with the information reported on Take-Two’ cash flow statement? If not, offer a plausible explanation for any discrepancy. (Hint: Combine both current and noncurrent balance sheet items related to software development costs and licenses.)

Step by Step Answer: