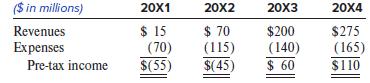

Devers Corporation began operations in 20X1 and had the following partial income statements, which are complete only

Question:

Devers Corporation began operations in 20X1 and had the following partial income statements, which are complete only down to pre-tax income. Devers had no book-tax differences except for the effects of its net operating loss carryforward. The corporate tax rate is 21%.

As of December 31, 20X1, and December 31, 20X2, Devers’s management determined that a valuation allowance equal to the full amount of any deferred tax asset it had was necessary. However, as of December 31, 20X3, it determined that no valuation at all was necessary. Devers had no income tax payable or receivable amounts at any December 31.

Required:

1. Determine Devers’s deferred tax asset balance, as reported in its balance sheet, as of December 31 for each year 20X1 through 20X4.

2. Determine the amount of tax paid by Devers, if any, in each year 20X1 through 20X4.

3. Determine the income tax expense (benefit) reported in Devers’s income statement in each year 20X1 through 20X4.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer