In Figland Companys first year of operations (2008), the company had pre-tax book income of ($500,000) and

Question:

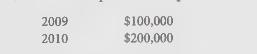

In Figland Company’s first year of operations (2008), the company had pre-tax book income of \($500,000\) and taxable income of \($800,000\) at the December year-end. Figland expected to maintain this level of taxable income in future years. Figland’s only temporary difference is for accrued product warranty costs, which are expected to be paid as follows:

The enacted income tax rate for these years is 30%. Figland believes there is a high likelihood that one-third of the tax benefit associated with this future deductible amount will not be realized.

Required:

Compute the amount of deferred tax asset and related valuation allowance that would be reported in Figland’s 2008 tax footnote.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: