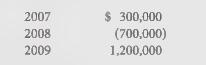

Operating income in Mobes first three years of operations was as follows: Mobe had no other deferred

Question:

Operating income in Mobe’s first three years of operations was as follows:

Mobe had no other deferred income taxes in any year, and its income tax rate is 30%. In 2008, Mobe elected to carry back the maximum amount of loss possible and expected to have sufficient taxable income in future years to take full advantage of the loss carryforward tax benefits.

Required:

1. What amount of tax benefit would be reported in Mobe’s 2008 income statement? Give the entry to record this tax benefit.

2. In 2009, what amount should Mobe report as its current income tax liability after considering the loss carryforward?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: