JD Electronics sells sound systems and other consumer electronics through a chain of retail outlets. Joanna Danielle,

Question:

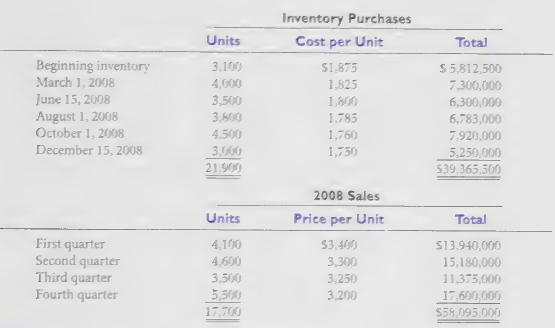

JD Electronics sells sound systems and other consumer electronics through a chain of retail outlets. Joanna Danielle, president of the company, recently read that many companies adopting the LIFO method of inventory valuation to reduce income taxes and eliminate gains from current period income. She wonders whether switching to LIFO from the company's current periodic FIFO inventory method would be beneficial. The following data concerning a popular model of entertainment center were taken from the company's inventory records:

Required:

1. Determine cost of goods sold for the entertainment centers under

(a) periodic FIFO and

(b) periodic LIFO. Ignore lower of cost or market considerations.

2. Assume that operating expenses of $15,000,000 are related to this product and that the company has a 35% income tax rate. Calculate net income under both inventory valuation methods.

3. Assume that the price trend on the entertainment centers is generally mirrored by the other items in JD Electronics inventory. Would the company be well advised to switch to the periodic LIFO method to value its inventory?

Step by Step Answer: