LM Ericsson is one of the world's largest suppliers of mobile and fixed-line telecommunications products. The company

Question:

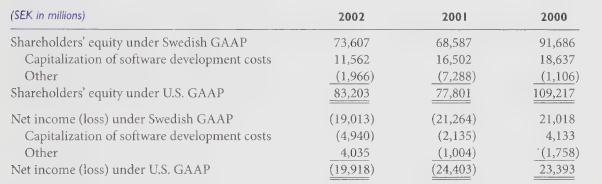

LM Ericsson is one of the world's largest suppliers of mobile and fixed-line telecommunications products. The company is headquartered in Stockholm, with shares listed in Sweden and other European exchanges, as well as American depository receipts (ADRs) listed on the NASDAQ market in the United States. Until 2002, the company expensed all software development. expenditures in conformity with Swedish GAAP. In 2002, Ericsson adopted SFAS No. 86, the U.S. accounting standard under which software development expenditures are capitalized when technical feasibility for that product is established. The company now amortizes software development assets over three to five years in addition to testing them for impairment annually. In the notes to its 2002 annual report, Ericsson disclosed that its expenditures on software development totaled 3,442, 8,084, and 11,339 in 2002, 2001, and 2000, respectively. (All data in this problem are stated in millions of Swedish kronor-SEK.) The notes also disclosed that intangible assets on the balance sheet contained the newly created software development asset. This asset's value was SEK3,200 million, which was net of accumulated amortization and impairment write-downs of 242 million. The company's 20-F filing with the U.S. SEC contained the following reconciliation to U.S.

Required:

1. Would Ericsson's net income have been higher or lower than that actually reported in 2000, 2001, and 2002 had the company always capitalized its software development expenditures? Explain.

2. Assuming that the company had always capitalized its software development expenditures, what would the value of the software development asset have been in the 2000, 2001, and 2002 balance sheets?

3. What was the impact of the company’s accounting change on the reported pre-tax loss for 2002?

Step by Step Answer: