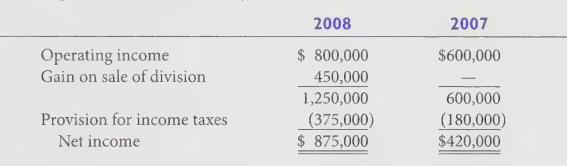

Munn Corporation's income statements for the years ended December 31, 2008 and 2007 included the following information

Question:

Munn Corporation's income statements for the years ended December 31, 2008 and 2007 included the following information before adjustments:

On January 1, 2008, Munn Corporation agreed to sell the assets and product line of one of its operating divisions for \($1,600,000\). The sale was consummated on December 31, 2008, and it resulted in a gain on disposition of \($450,000\). This division’s pre-tax net losses were \($320,000\) in 2008 and \($250,000\) in 2007. The income tax rate for both years was 30%.

Required:

Starting with operating income (before tax), prepare revised comparative income statements for 2008 and 2007 showing appropriate details for gain (loss) from discontinued operations (net of tax effects)?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: