Schlumberger Ltd. provides exploration and production services to the petroleum industry. The following footnote appeared in the

Question:

Schlumberger Ltd. provides exploration and production services to the petroleum industry.

The following footnote appeared in the company’s 2002 annual report:

As of December 31, 2002, the Company has two types of stock-based compensation plans. . . . Schlumberger applies APB Opinion 25 and related Interpretations in accounting for its plans. Accordingly, no compensation cost has been recognized for its stock option plans and its stock purchase plan. Had compensation cost for Schlumberger’s stock-based plans been determined based on the fair value at the grant dates for awards under those plans, consistent with the method of FASB Statement 123, Schlumberger’s net income and earnings per share would have been the pro forma amounts indicated below:

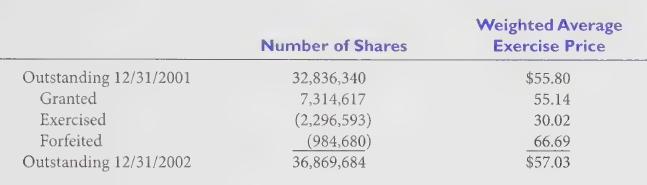

Stock Option Plans During 2002, 2001, and in prior years, officers and key employees were granted stock options under Schlumberger stock option plans. For all of the stock options granted, the exercise price of each option equals the market price of the Schlumberger stock on the date of grant, an option’s maximum life is ten years, and options generally vest in 20% increments over five years. ... As required by FASB Statement 123, the fair value of each grant is estimated on the date of grant using the multiple option Black-Scholes option-pricing model. A summary of the status of the Schlumberger stock option plans [follows]:

Elsewhere in the footnote, the company says that options for 21,142,473 shares were exercisable at year-end, and that the weighted average fair value of options granted during the year was \($20.22\).

Required:

1. Why doesn't Schlumberger grant stock options with a shorter term (say, three years) and vesting period (say, one year)?

2. How much compensation expense would the company have recorded in 2002 under APB No. 25 if the stock options granted that year had an exercise price \($2\) below the market price at the grant date?

3. What costs would Schlumberger employees have incurred if stock options granted in 2002 had an exercise price \($2\) below the grant date market price?

4, What journal entry would the company have made to record compensation expense for options granted in 2002 if it had used the fair value method of F ASB No. 123?

5. Based on the footnote information, why were some options exercised in 2002 while others were forfeited?

Step by Step Answer: