The following is adapted from the 2003 financial statements of the Mandalay Resort Group, one of the

Question:

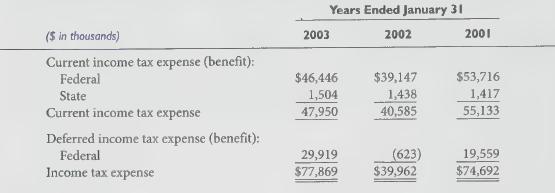

The following is adapted from the 2003 financial statements of the Mandalay Resort Group, one of the largest hotel/casino operators in the United States. The components of the provision for income taxes in fiscal years ended January 31, 2003, 2002, and 2001 were as follows:

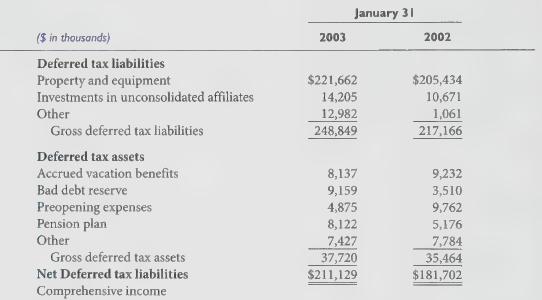

The income tax effects of temporary differences between financial and income tax reporting that gave rise to deferred income tax assets and liabilities at January 31, 2003 and 2002 follow:

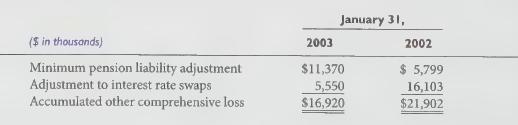

Other comprehensive income for the Company includes adjustments for minimum pension liability and adjustments to interest rate swaps, net of tax. The accumulated other comprehensive loss reflected on the balance sheet consisted of the following:

(Note: Mandalay reports its swap-related assets and liabilities on a net basis in the Other long term liabilities account.)

Required:

1. Provide journal entries to record the income tax expense for fiscal years 2001 through 2003. You may indicate the sum of the changes in the various deferred tax assets/liabilities by a single debit or credit to the Net deferred tax asset/liability account.

2. Refer to the deferred income tax asset and liability items reported by Mandalay at December 31, 2003 and 2002. For each item (except Other), determine whether the balance changed because of a net originating or net reversing timing difference. Provide a likely explanation for each of the timing differences and clearly discuss whether it indicates a higher or lower financial reporting revenue or expense relative to the amount reported on the fiscal 2003 tax return.

3. Mandalay’s reported deferred tax expense in 2003 \($29,919\) does not equal the reported increase in net deferred tax liability \($211,129\) — \($181,702\) = \($29,427\) over the course of fiscal 2003. Is this difference explained by Mandalay’s comprehensive income disclosure?

Provide calculations to support your answer.

Step by Step Answer: