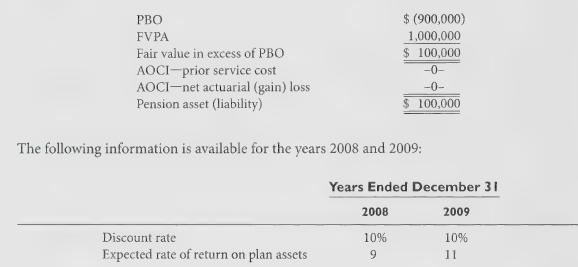

The following is the funded status of the pension plan of McKeown Consulting Company at December 31,

Question:

The following is the funded status of the pension plan of McKeown Consulting Company at December 31, 2007:

The service costs for 2008 and 2009 were \($125,000\) and \($145,000\), respectively. During the years 2008 and 2009, the pension fund's actual earnings were \($100,000\) and \($64,740\), respectively.

At the end of 2008, McKeown retroactively enhanced the benefits provided under its pension plan, and this increased the PBO by \($110,000\). The average remaining service period of employees expected to receive these retroactive benefits under the plan was 10 years.

During 2008 and 2009, the company contributed \($99,000\) and \($123,000\), respectively, to the pension fund. In turn, the pension fund paid \($120,000\) and \($85,000\), respectively to the retired employees during the same periods.

Required:

1. Compute pension expense for the years 2008 and 2009.

2. Calculate the ending balances for PBO, fair value of plan assets, funded status, AOCI—

prior service costs, and AOCI—net actuarial (gain) loss at the end of 2008 and 2009.

3. Provide necessary journal entries in McKeown’s books for the years 2008 and 2009 to record all transactions and events relating to its pension plan.

4. Show that the journal entries result in a balance sheet pension asset (liability) equal to the funded status.

Step by Step Answer: