Thompson Traders started its business on January 1, 2004. The following information pertains to the companys accounts

Question:

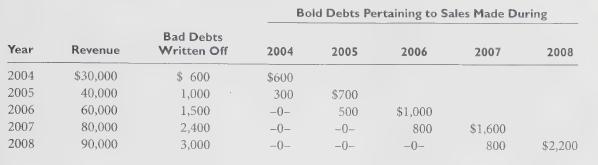

Thompson Traders started its business on January 1, 2004. The following information pertains to the company’s accounts receivable during the first five years of its operations:

The company typically sells on credit to its customers. All sales made in a given calendar year are fully settled by the following year, by which time al! uncollected receivables are written off.

Since inception, Thompson has recorded bad debts expense at 2.75% of its revenue. After five years of operation, the company is now considering a reevaluation ofi ts bad debts formula before finalizing its financial statements for the year 2008. The following are excerpts taken from a recent meeting of Thompson's managers discussing this issue:

Tony Barclay, Corporate Accounting: Our experience suggests that the bad debts written off have ballooned from 2% of revenues to almost 3.5%. So, while we were being very conservative in the earlier years, currently our provisions are much below our actuals. Conservatively, I recommend a formula of 3.5% of revenues.

Ian Spencer, manager, Accounts Receivable: While I agree with Tony’s computations, my experience suggests that the quality of our receivables has pretty much remained the same and I don't expect them to change in the near future. Therefore, | recommend that we retain our current formula.

Brian Joshi, outside consultant: If you believe that you have under- or overprovided for bad debts over the last four years, you have to revise the formula to reflect your past experience and current expectations. While revising the formula will lead to correct expensing in the future, you also have to adjust the allowance account for past estimation errors. More important, because this will be considered as a change in accounting methods, you have to restate the past financial statements.

Required:

You have been hired as a summer intern in the corporate controller's office to examine Thompson's bad debt accounting. Based on the information provided, write a report to top management assessing the company’s bad debt formula and provide specific recommendations to improve its accounting, if needed. In completing the report, please address all issues raised during the recent company meeting.

Step by Step Answer: