If the US dollar were chosen as the functional currency for Acceletron in 2007, Redline could reduce

Question:

If the US dollar were chosen as the functional currency for Acceletron in 2007, Redline could reduce its balance sheet exposure to exchange rates by:

A. selling SGD30 million of fixed assets for cash.

B. issuing SGD30 million of long-term debt to buy fixed assets.

C. issuing SGD30 million in short-term debt to purchase marketable securities.

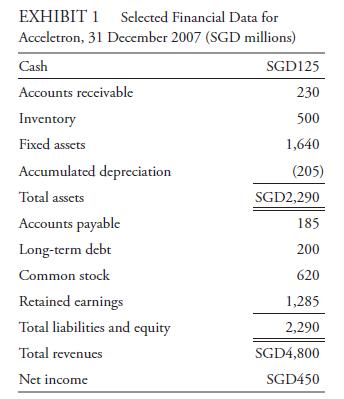

Redline Products, Inc. is a US-based multinational with subsidiaries around the world. One such subsidiary, Acceletron, operates in Singapore, which has seen mild but not excessive rates of inflation. Acceletron was acquired in 2000 and has never paid a dividend. It records inventory using the FIFO method.

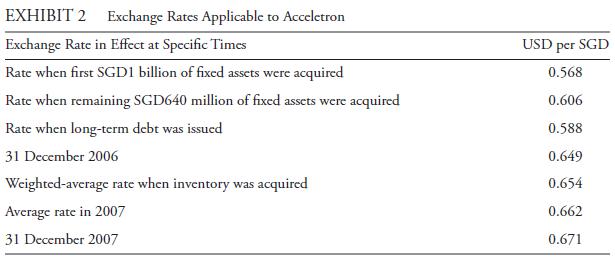

Chief Financial Officer Margot Villiers was asked by Redline’s board of directors to explain how the functional currency selection and other accounting choices affect Redline’s consolidated financial statements. Villiers gathers Acceletron’s financial statements denominated in Singapore dollars (SGD) in Exhibit 1 and the US dollar/Singapore dollar exchange rates in Exhibit 2. She does not intend to identify the functional currency actually in use but rather to use Acceletron as an example of how the choice of functional currency affects the consolidated statements.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie