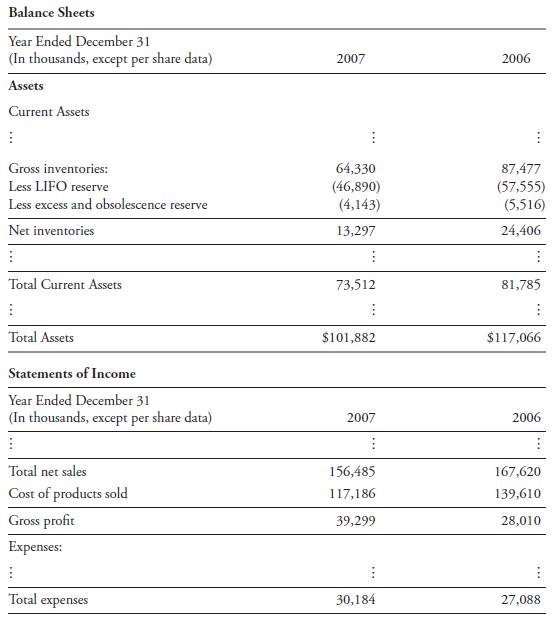

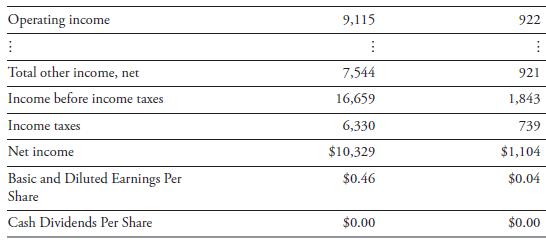

The following excerpts are from the 2007 10-K of Sturm Ruger & Co., Inc. (NYSE: RGR): Item

Question:

The following excerpts are from the 2007 10-K of Sturm Ruger & Co., Inc. (NYSE: RGR):

Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations

“Reduction in inventory generated positive cash flow for the Company, partially off set by the tax impact of the consequent LIFO liquidation, which generated negative cash flow as it created taxable income, resulting in higher tax payments.”

Notes to Financial Statements 1. Significant Accounting Policies

:

Inventories Inventories are stated at the lower of cost, principally determined by the lastin, first-out (LIFO) method, or market. If inventories had been valued using the first-in, first-out method, inventory values would have been higher by approximately $46.9 million and $57.6 million at December 31, 2007 and 2006, respectively. During 2007 and 2006, inventory quantities were reduced.

Th is reduction resulted in a liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years as compared with the current cost of purchases, the effect of which decreased costs of products sold by approximately $12.1 million and $7.1 million in 2007 and 2006, respectively. There was no LIFO liquidation in 2005.

1. What is the decrease in the LIFO reserve on the balance sheet? How much less was the cost of products sold in 2007, because of LIFO liquidation, according to the note disclosure?

2. How did the decreased cost of products sold compare to operating income in 2007?

3. How did the LIFO liquidation affect cash flows?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie