Question:

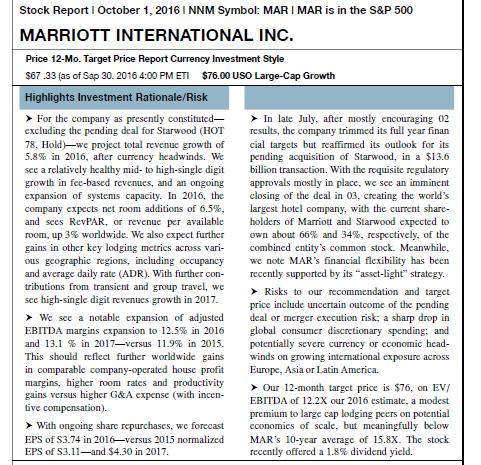

D15-48. Interpreting Analysts Reports that Use Valuation with Multiples Refer to the following excerpts from an analysts’ report (11 pages total) covering Marriott International Inc. to complete the following requirements.

Required

a. What method is this analyst using to value Marriott?

b. What is this analyst’s price target for Marriott? If Marriott achieves that target in the next twelve months, what would be an investor’s return? Explain.

c. Describe how this analyst justifies the price target.

d. Is there any other information in these excerpts that you might use to value Marriott? Explain.

Transcribed Image Text:

Stock Report | October 1, 2016 | NNM Symbol: MAR I MAR is in the S&P 500 MARRIOTT INTERNATIONAL INC. Price 12-Mo. Target Price Report Currency Investment Style $67.33 (as of Sap 30, 2016 4:00 PM ETI $76.00 USO Large-Cap Growth Highlights Investment Rationale/Risk For the company as presently constituted- excluding the pending deal for Starwood (HOT 78. Hold)-we project total revenue growth of 5.8% in 2016, after currency headwinds. We see a relatively healthy mid- to high-single digit growth in fee-based revenues, and an ongoing expansion of systems capacity. In 2016, the company expects net room additions of 6.5%, and sees RevPAR, or revenue per available room, up 3% worldwide. We also expect further gains in other key lodging metrics across vari- ous geographic regions, including occupancy and average daily rate (ADR). With further con- tributions from transient and group travel, we see high-single digit revenues growth in 2017. We see a notable expansion of adjusted EBITDA margins expansion to 12.5% in 2016 and 13.1% in 2017-versus 11.9% in 2015. This should reflect further worldwide gains in comparable company-operated house profit margins, higher room rates and productivity gains versus higher G&A expense (with incen- tive compensation). With ongoing share repurchases, we forecast EPS of $3.74 in 2016-versus 2015 normalized EPS of S3.11-and $4.30 in 2017. In late July, after mostly encouraging 02 results, the company trimmed its full year finan cial targets but reaffirmed its outlook for its pending acquisition of Starwood, in a $13.6 billion transaction. With the requisite regulatory approvals mostly in place, we see an imminent closing of the deal in 03, creating the world's largest hotel company, with the current share- holders of Marriott and Starwood expected to own about 66% and 34%, respectively, of the combined entity's common stock. Meanwhile, we note MAR's financial flexibility has been recently supported by its "asset-light" strategy. Risks to our recommendation and target price include uncertain outcome of the pending deal or merger execution risk; a sharp drop in global consumer discretionary spending; and potentially severe currency or economic head- winds on growing international exposure across Europe, Asia or Latin America. Our 12-month target price is $76, on EV/ EBITDA of 12.2X our 2016 estimate, a modest premium to large cap lodging peers on potential economies of scale, but meaningfully below MAR's 10-year average of 15.8X. The stock recently offered a 1.8% dividend yield.