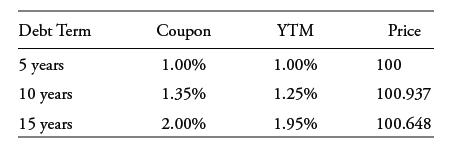

A Sydney-based investor notes the following available option-free bonds for an A rated Australian issuer: The 5-year,

Question:

A Sydney-based investor notes the following available option-free bonds for an A rated Australian issuer:

The 5-year, 10-year, and 15-year Australian government bonds have YTMs and coupons of 0.50%, 0.75%, and 1.10%, respectively, and both corporate and government bonds have a semiannual coupon. As an active manager who expects stable benchmark yields and credit spreads over the next six months, the investor decides to overweight (by AUD50,000,000 in face value) the issuer’s 15-year versus 10-year bond for that period. Calculate the return to the investor of the roll-down strategy in AUD and estimate the returns attributable to benchmark yield versus credit spread changes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: