Returning to our earlier example of the German media and telecommunications issuer, the investor decides instead to

Question:

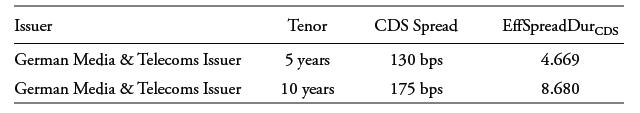

Returning to our earlier example of the German media and telecommunications issuer, the investor decides instead to position her portfolio for a steepening of the issuer’s credit curve using the CDS market. Details of on-the-run 5- and 10-year CDS contracts outstanding are as follows.

Describe an appropriate long–short CDS strategy to meet this goal assuming a €10,000,000 10-year CDS contract notional. Calculate the investor’s return if the 5-year spreads rise 10 bps and the 10-year spreads rise 20 bps.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: