An investor is faced with an active portfolio decision across three bond rating categories based on the

Question:

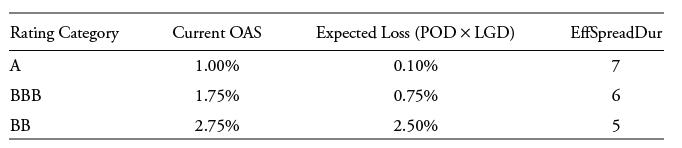

An investor is faced with an active portfolio decision across three bond rating categories based on the following current market information: Which active bond portfolio maximizes expected excess return under a stable credit market assumption versus an equally weighted benchmark portfolio across the three rating categories?

Which active bond portfolio maximizes expected excess return under a stable credit market assumption versus an equally weighted benchmark portfolio across the three rating categories?

A. 50% A rated bonds, 50% BBB rated bonds

B. 50% BBB rated bonds, 50% BB rated bonds

C. 50% A rated bonds, 50% B rated bonds

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: