As in the prior example, an active fixed-income manager anticipates an economic rebound that is expected to

Question:

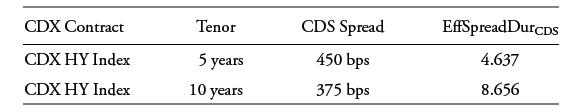

As in the prior example, an active fixed-income manager anticipates an economic rebound that is expected to cause high-yield credit curve steepening. The manager chooses a tactical CDX strategy combining 5-year and 10-year credit positions to capitalize on this view. Current market information for these high-yield CDX contracts is as follows:

Describe an appropriate duration-neutral portfolio positioning strategy to capitalize on this view using these CDX HY contracts. Calculate the return assuming that 5-year CDX spreads immediately fall by 175 bps and 10-year spreads decline by 25 bps for an equivalent $10,000,000 notional on the 10-year CDX index contract.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: