Based on Exhibit 1, the results of Analysis 1 should show the yield on the 20-year bond

Question:

Based on Exhibit 1, the results of Analysis 1 should show the yield on the 20-year bond decreasing by:

A. 0.3015%.

B. 0.6030%.

C. 0.8946%.

Rowan Madison is a junior analyst at Cardinal Capital. Sage Winter, a senior portfolio manager and Madison’s supervisor, meets with Madison to discuss interest rates and review two bond positions in the firm’s fixed-income portfolio.

Winter begins the meeting by asking Madison to state her views on the term structure of interest rates. Madison responds:

“Yields are a reflection of expected spot rates and risk premiums. Investors demand risk premiums for holding long-term bonds, and these risk premiums increase with maturity.”

Winter tells Madison that, based on recent changes in spreads, she is concerned about a perceived increase in counterparty risk in the economy and its effect on the portfolio. Madison asks Winter:

“Which spread measure should we use to assess changes in counterparty risk in the economy?”

Winter is also worried about the effect of yield volatility on the portfolio. She asks Madison to identify the economic factors that affect short-term and long-term rate volatility. Madison responds:

“Short-term rate volatility is mostly linked to uncertainty regarding monetary policy, whereas long-term rate volatility is mostly linked to uncertainty regarding the real economy and inflation.”

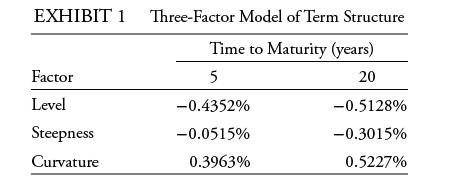

Finally, Winter asks Madison to analyze the interest rate risk portfolio positions in a 5-year and a 20-year bond. Winter requests that the analysis be based on level, slope, and curvature as term structure factors. Madison presents her analysis in Exhibit 1.

Winter asks Madison to perform two analyses:

Analysis 1: Calculate the expected change in yield on the 20-year bond resulting from a two-standard-deviation increase in the steepness factor.

Analysis 2: Calculate the expected change in yield on the five-year bond resulting from a one-standard-deviation decrease in the level factor and a one-standard deviation decrease in the curvature factor.

Step by Step Answer: