Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X)

Question:

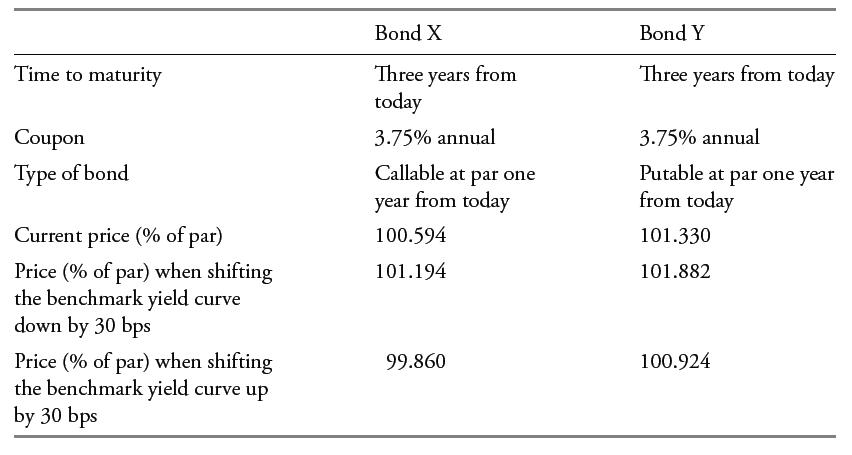

Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X) and a putable bond (Bond Y). She wants to examine the interest rate sensitivity of these two bonds to a parallel shift in the benchmark yield curve. Assuming an interest rate volatility of 10%, her valuation software shows how the prices of these bonds change for 30 bps shifts up or down:

The effective duration for Bond X is closest to:

A. 0.67.

B. 2.21.

C. 4.42.

Transcribed Image Text:

Time to maturity Coupon Type of bond Current price (% of par) Price (% of par) when shifting the benchmark yield curve down by 30 bps Price (% of par) when shifting the benchmark yield curve up by 30 bps Bond X Three years today 3.75% annual from Callable at par one year from today 100.594 101.194 99.860 Bond Y Three years from today 3.75% annual Putable at par one year from today 101.330 101.882 100.924

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

B is correct The effective duration for Bond X is A is incorrect because ...View the full answer

Answered By

Hassan Ali

I am an electrical engineer with Master in Management (Engineering). I have been teaching for more than 10years and still helping a a lot of students online and in person. In addition to that, I not only have theoretical experience but also have practical experience by working on different managerial positions in different companies. Now I am running my own company successfully which I launched in 2019. I can provide complete guidance in the following fields. System engineering management, research and lab reports, power transmission, utilisation and distribution, generators and motors, organizational behaviour, essay writing, general management, digital system design, control system, business and leadership.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X) and a putable bond (Bond Y). She wants to examine the interest rate sensitivity of these two bonds...

-

Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X) and a putable bond (Bond Y). She wants to examine the interest rate sensitivity of these two bonds...

-

Erna Smith, a portfolio manager, has two fixed-rate bonds in her portfolio: a callable bond (Bond X) and a putable bond (Bond Y). She wants to examine the interest rate sensitivity of these two bonds...

-

Wynn Resorts owns a variety of popular gaming resorts. Its annual report contained the following information: Debenture Conversions Our convertible debentures are currently convertible at each...

-

The Celtics Basketball Holdings, L.P. and Subsidiary included the following note in its 1998 annual report: Note GCommitments and Contingencies (in Part) National Basketball Association (NBA)...

-

An investor is considering the purchase of an 8%, 18-year corporate bond thats being priced to yield 10%. She thinks that in a year, this bond will be priced in the market to yield 9%. Using annual...

-

The telephone company offers a variety of services. A business research firm is hired to determine the level of customer satisfaction by target audience with its land-based telephone service, its...

-

Identify which qualitative characteristic of accounting information is best described in each item below. (Do not use relevance and reliability.) (a) The annual reports of Best Buy Co. are audited by...

-

2020 2021 SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Liabilities and Owners' Equity Current assets Current liabilities Cash $ 24,076 $ 24.400 Accounts payable Accounts...

-

A three-year floating rate bond pays annual coupons of one-year reference rate (set in arrears) and is capped at 5.600%. The reference rate swap curve is as given in Exhibit 1 (i.e., the one-year,...

-

Which of the following statements comparing the HoLee and KalotayWilliams Fabozzi (KWF) equilibrium term structure models is correct? A. The HoLee model assumes constant volatility, while the KWF...

-

The shareholders of Bread Company have voted in favor of a buyout offer from Butter Corporation. Information about each firm is given here: Breads shareholders will receive one share of Butter stock...

-

Determine if Heards statements are correct. Justify your response. Laura Powers is a senior investment analyst at Brotley University Foundation and works for the university endowment. Powers is...

-

Determine the most appropriate rebalancing choice for the Foundations investment team. Justify your response. The Lemont Family Foundation follows a systematic quarterly rebalancing policy based on...

-

The following account balances, in alphabetical order, are from the general ledger of Milo's Waterproofing Service at January 31. The firm began business on January 1 . All accounts have normal...

-

Pascall Company has the following information available for the past year: The companys hurdle rate is 10 percent. 1. Determine Pascalls return on investment (ROI) and residual income for each...

-

A company allocates overhead using direct labor hours. The expected number of direct labor hours is 4,000 for the coming year and the expected overhead is \($80,000.\) During the year, the company...

-

Veronique is nearsighted; she cannot see clearly anything more than 6.00 m away without her contacts. One day she doesn't wear her contacts; rather, she wears an old pair of glasses prescribed when...

-

Some people argue that the internal control requirements of the Sarbanes-Oxley Act (SOX) put U.S. companies at a competitive disadvantage to companies outside the United States. Discuss the...

-

Today, Juanita purchases a 15-year, 7% bond of the Sunflower Corporation issued four years ago at par. She purchases the bond as an investment at a discount from the par value. If she sells the bonds...

-

Judy just obtained a patent on a new product she has developed. Bell Corporation wishes to market the product and will pay 12% of all future sales of the product to Judy. How can she be sure that the...

-

When is the transferor of a franchise unable to treat the transfer as a sale or an exchange of a capital asset?

-

Need help with every part!!!! Bill Smith is reviewing the cash accounting for Postalman, Inc.a local mailing service. Smith's review will focus on the petty cash account and the bank reconciliation...

-

Janco Industries has a relevant range extending to 30,000 units each month. The following performance report provides information about Janco's budget and actual performance for November. (Click the...

-

On September 18, 2019, Rose Company purchased 11,800 shares (14%) of Wozniak, Inc. stock for $42 per share. The market value of the Wozniak stock at December 31, 2019 was $29 per share. Rose Company...

Study smarter with the SolutionInn App