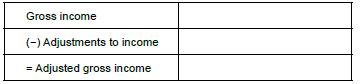

3. Using Exhibit 31 as a guide, calculate Jamie Lees adjusted gross income amount by completing the...

Question:

3. Using Exhibit 3–1 as a guide, calculate Jamie Lee’s adjusted gross income amount by completing the table below:

Jamie Lee Jackson, age 26, is in her last semester of college, and graduation day is just around the corner! It is the time of year again when Jamie Lee must file her annual federal income taxes. Last year, she received an increase in salary from the bakery, which brought her gross monthly earnings to $2,550, and she also opened up an IRA, to which she contributed $300. Her savings accounts earn 2 percent interest per year, and she also received an unexpected $1,000 gift from her great aunt. Jamie was also lucky enough last year to win a raffle prize of $2,000, most of which was deposited into her regular savings account after paying off her credit card balance.

Current Financial Situation Assets:

Checking account, $2,250 Savings account, $6,900 (interest earned last year: $125)

Emergency fund savings account, $3,900 (interest earned last year: $75)

IRA balance, $350 ($300 contribution made last year)

Car, $3,000 Liabilities:

Student loan, $10,800 Credit card balance, $0 (interest paid last year: $55)

Income:

Gross monthly salary, $2,550 Monthly Expenses:

Rent obligation, $275 Utilities obligation, $135 Food, $130 Gas/Maintenance, $110 Credit card payment, $0 Savings:

Regular savings monthly deposit, $175 Rainy day savings monthly deposit, $25 Entertainment:

Cake decorating class, $40 Movies with friends, $60

Step by Step Answer:

Focus On Personal Finance

ISBN: 9781259919657

6th Edition

Authors: Jack Kapoor, Les Dlabay, Robert Hughes, Melissa Hart