Jamie Lee Jackson, age 26, is in her last semester of college and is waiting for graduation

Question:

Jamie Lee Jackson, age 26, is in her last semester of college and is waiting for graduation day, just around the corner! It is the time of year again when Jamie Lee must file her annual federal income taxes. Last year, she received an increase in salary from the bakery, which brought her gross monthly earnings to $2,550, and she also opened an IRA, to which she contributed $300. Her savings accounts earn 1 percent interest per year, and she also had received an unexpected $1,500 gift from her great aunt. Jamie was also lucky enough last year to win a raffle prize of $2,000, most of which was deposited into her regular savings account after paying off her credit card balance.

Current Financial Situation

Assets:

1. Checking account: $2,250 2. Savings account: $6,900 (Interest earned last year: $125)

3. Emergency fund savings account: $3,900 (Interest earned last year: $75)

4. IRA balance: $350 ($300 contribution made last year)

5. Car: $3,000

Liabilities:

1. Student loan: $10,800

2. Credit card balance: $0 (Interest paid last year: $55)

Income:

1. Gross monthly salary: $2,550

Monthly Expenses:

1. Rent obligation: $275

2. Utilities obligation: $135

3. Food: $130

4. Gas/maintenance: $110

5. Credit card payment: $0

Savings:

1. Regular savings monthly deposit: $175

2. Rainy day savings monthly deposit: $25

Entertainment:

1. Cake decorating class: $40

2. Movies with friends: $60

Questions

1. What impact on Jamie Lee’s income would the gift of $1,500 from her great aunt have on her adjusted gross income? Would there be an impact on the adjusted gross income with her $2,000 raffle prize winnings? Explain your answer.

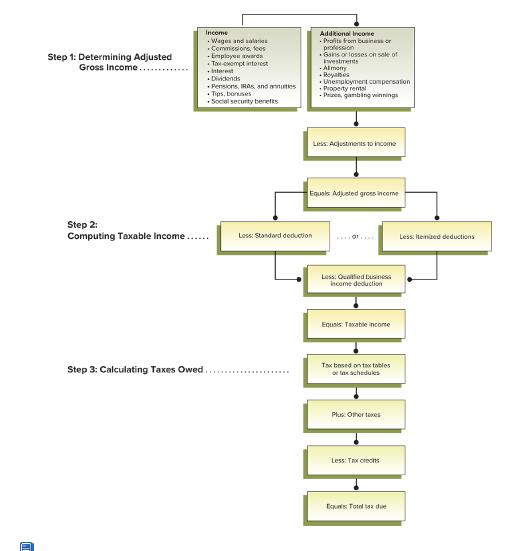

2. Using Exhibit 4-1 as a guide, calculate Jamie Lee’s adjusted gross income amount by completing the following table.

3. What would Jamie Lee’s filing status be considered? Would you choose the standard deduction allowance or the itemized deduction allowance in Jamie’s situation? Based on your choice, what would the deduction amount be?

4. In Jamie Lee’s situation, what is her marginal tax rate? How would a marginal tax rate compare to an average tax rate?

Step by Step Answer:

Personal Finance

ISBN: 9781264101597

14th Edition

Authors: Jack Kapoor, Les Dlabay, Robert Hughes, Melissa Hart