Citrus Products Inc. is a medium-sized producer of citrus juice drinks with groves in Indian River County,

Question:

Citrus Products Inc. is a medium-sized producer of citrus juice drinks with groves in Indian River County, Florida. Until now, the company has confined its operations and sales to the United States, but its CEO, George Gaynor, wants to expand into the Pacific Rim. The first step would be to set up sales subsidiaries in Japan and Australia, then to set up a production plant in Japan, and, finally, to distribute the product throughout the Pacific Rim. The firm’s financial manager, Ruth Schmidt, is enthusiastic about the plan, but she is worried about the implications of the foreign expansion on the firm’s financial management process. She has asked you, the firm’s most recently hired financial analyst, to develop a 1-hour tutorial package that explains the basics of multinational financial management. The tutorial will be presented at the next board of directors meeting. To get you started, Schmidt has supplied you with the following list of questions.

a. What is a multinational corporation? Why do firms expand into other countries?

b. What are the 5 major factors that distinguish multinational financial management from financial management as practiced by a purely domestic firm?

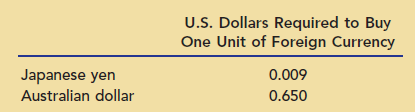

c. Consider the following illustrative exchange rates:

(1) Are these currency prices direct quotations or indirect quotations?

(2) Calculate the indirect quotations for yen and Australian dollars.

(3) What is a cross rate? Calculate the two cross rates between yen and Australian dollars.

(4) Assume Citrus Products can produce a liter of orange juice and ship it to Japan for $1.75. If the firm wants a 50 percent markup on the product, what should the orange juice sell for in Japan?

(5) Now, assume Citrus Products begins producing the same liter of orange juice in Japan. The product costs 250 yen to produce and ship to Australia, where it can be sold for 6 Australian dollars. What is the U.S. dollar profit on the sale?

(6) What is exchange rate risk?

d. Briefly describe the current international monetary system. What are the different types of exchange rate systems?

e. What is the difference between spot rates and forward rates? When is the forward rate at a premium to the spot rate? At a discount?

f. What is interest rate parity? Currently, you can exchange 1 yen for 0.0095 U.S. dollar in the 30-day forward market, and the risk-free rate on 30-day securities is 4 percent in both Japan and the United States. Does interest rate parity hold? If not, which securities offer the highest expected return?

g. What is purchasing power parity (PPP)? If grapefruit juice costs $2.00 a liter in the United States and purchasing power parity holds, what should be the price of grapefruit juice in Australia?

h. What effect does relative inflation have on interest rates and exchange rates?

i. (1) Briefly explain the three major types of international credit markets.

(2) Briefly explain how ADRs work.

j. To what extent do average capital structures vary across different countries?

k. What is the effect of multinational operations on each of the following financial management topics?

(1) Cash management.

(2) Capital budgeting decisions.

(3) Credit management.

(4) Inventory management.

Capital BudgetingCapital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-0324302691

11th edition

Authors: Eugene F. Brigham, Joel F. Houston