7 The cost of hedging payables. Assume that Loras (UK) Ltd imported goods from New Zealand and...

Question:

7 The cost of hedging payables. Assume that Loras

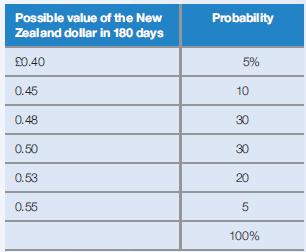

(UK) Ltd imported goods from New Zealand and needs 100 000 New Zealand dollars 180 days from now. It is trying to determine whether to hedge this position. Loras has developed the following probability distribution for the New Zealand dollar:

The 180-day forward rate of the New Zealand dollar is £0.52. The spot rate of the New Zealand dollar is £0.49. Develop a table showing a feasibility analysis for hedging. That is, determine the possible differences between the costs of hedging versus no hedging. What is the probability that hedging will be more costly to the firm than not hedging? Determine the expected value of the additional cost of hedging.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: