16. Larrys Athletic Lounge is planning an expansion program to increase the sophistication of its exercise equipment.

Question:

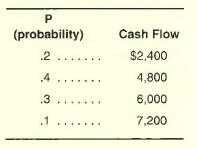

16. Larry’s Athletic Lounge is planning an expansion program to increase the sophistication of its exercise equipment. Larry is considering some new equipment priced at $20,000 with an estimated life of five years. Larry is not sure how many members the new equipment will attract, but he estimates his increased yearly cash flows for each of the next five years will have the probability distribution given below. Larry’s cost of capital is 14 percent.

a. What is the expected value of the cash flow? The value you compute will apply to each of the five years.

b. What is the expected net present value?

c. Should Larry buy the new equipment?

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9780073382388

13th Edition

Authors: Stanley B. Block, Geoffrey A. Hirt, Bartley R. Danielsen