19. Referring to problem 18, Mr. Terry is likely to hold the shopping center of his choice...

Question:

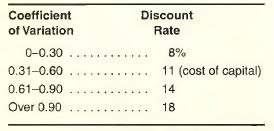

19. Referring to problem 18, Mr. Terry is likely to hold the shopping center of his choice for 25 years and will use this period for decision-making purposes. Either shopping center can be purchased for $300,000. Mr. Terry uses a risk-adjusted discount rate when evaluating investments. His scale is related to the coefficients of variation presented below.

a. Compute the risk-adjusted net present value for Wrigley Village and Crosley Square. You can get the coefficient of variation and cash flow figures (in thousands) from the previous problem.

b. Which investment should Mr. Terry accept if the two investments are mutually exclusive? If the investments are not mutually exclusive and no capital rationing is involved, how would your decision be affected?

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9780073382388

13th Edition

Authors: Stanley B. Block, Geoffrey A. Hirt, Bartley R. Danielsen