20. Roper Fashions is preparing a product strategy for the fall season. One option is to go...

Question:

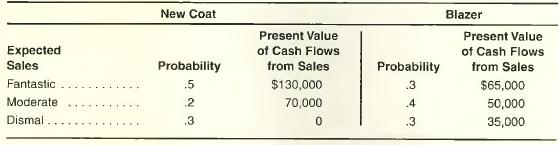

20. Roper Fashions is preparing a product strategy for the fall season. One option is to go to a highly imaginative new, four-gold-button sport coat with special emblems on the front pocket. The all-wool product would be available for both males and females. A second option would be to produce a traditional blue blazer line. The marketing research department has determined that the new, four-goldbutton coat and traditional blue blazer line offer the probabilities of outcomes and related cash flows shown below.

The initial cost to get into the new coat line is $50,000 in designs, equipment, and inventory. The blazer line would carry an initial cost of $30,000.

a. Diagram a complete decision tree of possible outcomes similar to Figure 13-8 on page 419. Take the analysis all the way through the process of computing expected NPV (last column) for each investment.

b. Given the analysis in part

a, would you automatically make the investment indicated?

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9780073382388

13th Edition

Authors: Stanley B. Block, Geoffrey A. Hirt, Bartley R. Danielsen