Suppose you are a typical person in the Australian economy. You pay the 2 per cent Medicare

Question:

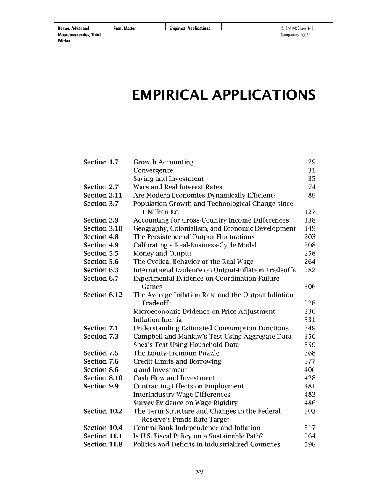

Suppose you are a typical person in the Australian economy. You pay the 2 per cent Medicare levy, and personal income taxes as in Table 12.2. How much tax do you pay if you earn $54000 a

year? What are your average and marginal tax rates? What happens to your tax bill, and to your average and marginal tax rates, if your income rises to $90 000?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: