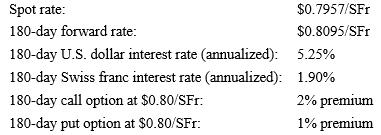

Dow Chemical has sold SFr 25 million in chemicals to Ciba-Geigy. Payment is due in 180 days.

Question:

Dow Chemical has sold SFr 25 million in chemicals to Ciba-Geigy. Payment is due in 180 days.

a. What is the hedged value of Dow’s receivable using the forward market hedge? The money market hedge?

b. What alternatives are available to Dow to use currency options to hedge its receivable? Which option hedging strategy would you recommend?

c. Which hedging alternative analyzed in parts a and b would you recommend to Dow? Why?

Transcribed Image Text:

Spot rate: 180-day forward rate: 180-day U.S. dollar interest rate (annualized): 180-day Swiss franc interest rate (annualized): 180-day call option at $0.80/SFr: 180-day put option at $0.80/SFr: $0.7957/SFr $0.8095/SFr 5.25% 1.90% 2% premium 1% premium

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

a Dow Chemical can use a forward contract to lock in a value of 20237500 25000000 08095 for its rece...View the full answer

Answered By

Salmon ouma

I am a graduate of Maseno University, I graduated with a second class honors upper division in Business administration. I have assisted many students with their academic work during my years of tutoring. That has helped me build my experience as an academic writer. I am happy to tell you that many students have benefited from my work as a writer since my work is perfect, precise, and always submitted in due time. I am able to work under very minimal or no supervision at all and be able to beat deadlines.

I have high knowledge of essay writing skills. I am also well conversant with formatting styles such as Harvard, APA, MLA, and Chicago. All that combined with my knowledge in methods of data analysis such as regression analysis, hypothesis analysis, inductive approach, and deductive approach have enabled me to assist several college and university students across the world with their academic work such as essays, thesis writing, term paper, research project, and dissertation. I have managed to help students get their work done in good time due to my dedication to writing.

5.00+

4+ Reviews

16+ Question Solved

Related Book For

Foundations Of Multinational Financial Management

ISBN: 9780470128954

6th Edition

Authors: Alan C Shapiro, Atulya Sarin

Question Posted:

Students also viewed these Business questions

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

You are working in the Forex Division of Flaggy Bank, Melbourne. You regularly report to your boss, the Manager of the Treasury and Forex Division. Suppose you observe the following interest rates,...

-

1. Should Sandy do exactly what the partner suggests, or risk losing the business for the firm, and perhaps her job, by suggesting a different approach? 2. What might be an alternative approach? 3....

-

Use the indirect method to determine cash flows from operating activities Haughton Incorporated presents its statement of cash flows using the indirect method. The following accounts and...

-

1. Help McDavis with the analysis by calculating KPIs for: (a) Unit fill rate; (b) Fulfillment accuracy; (c) Document accuracy; (d) On-time dispatch; and (e) Productivity. 2. Compare your KPIs to the...

-

Use the PewWorkPlay dataset to build a crosstab that addresses this assumption: those who do manual/physical labor are more concerned about robots and computers taking over their jobs in 50 years...

-

What is block ownership? How does it affect corporate governance?

-

A project has annual cash flows of $6,500 for the next 10 years and then $8,000 each year for the following 10 years. The IRR of this 20-year project is 10.56%. If the firm's WACC is 8%, what is the...

-

Kemp & Beatley is a New York importer of table linens and accessories. It hedges all its import orders using forward contracts. Does Kemp & Beatley face any exchange risk? Explain

-

Cooper Inc., a U.S. firm, has just invested 500,000 in a note that will come due in 90 days and is yielding 9.5% annualized. The current spot value of the pound is $1.9612 and the 90-day forward rate...

-

Avis Rent A Car maintains a fleet of low-mileage cars for its customer base. Suppose that Avis would like to promote the fact that its cars have a lower average mileage than that of its competitors...

-

A monopolist produces sets/boxes of golf balls. Assume that the demand for a set of golf balls is P=100-Q and its MC=20. Suppose the monopolist sets a two-part tariff (a per unit fee and a lump sum...

-

To demonstrate competency in this unit, a person must: Call an Auction Instructions in second document titled Auction Script Guide Execute the contract for the successful bidder This can be a...

-

3. Customers arrive at a two-server service station according to a Poisson process with rate A. Whenever a new customer arrives, any customer in the system immediately departs. A new arrival enters...

-

Question 8 A national survey of 600 Formula One fans was conducted to learn if they can afford the Austin Cota F1 race tickets. Use the data from the excel file to solve the following. What's the...

-

Could you please check and send me the last results, because the system announced the wrong answer. Thanks Question 1 George was offered two options for a car he was purchasing: Lease option: Pay...

-

Polly Propylene has started two polymerization reactions. One flask contains a monomer that polymerizes by a chain-growth mechanism, and the other flask contains a monomer that polymerizes by a...

-

A 6-lb shell moving with a velocity ?? v0k explodes at point D into three fragments which hit the vertical wall at the points indicated. Fragments A, B, and C hit the wall 0.010 s, 0.018 s, and 0.012...

-

Consider the following alternatives: Use present worth analysis, an 8% interest rate, and an infinite analysis period. Which alternative should be selected in each of the two following situations? 1....

-

A problem often discussed in the engineering economy literature is the "oil-well pump problem"} Pump 1is a small pump; Pump 2 is a larger pump that costs more, will produce slightly more oil, and...

-

Three mutually exclusive alternatives are being studied. If the MARR is 12%, which alternative should be selected? Year A B -$20,000 -$20,000 -$20,000 +10,000 +10,000 +5,000 +10,000 2 +5,000 +5,000...

-

Los datos de la columna C tienen caracteres no imprimibles antes y despus de los datos contenidos en cada celda. En la celda G2, ingrese una frmula para eliminar cualquier carcter no imprimible de la...

-

Explain impacts of changing FIFO method to weighted average method in inventory cost valuations? Explain impacts of changing Weighted average method to FIFO method in inventory cost valuations?...

-

A perpetuity makes payments starting five years from today. The first payment is 1000 and each payment thereafter increases by k (in %) (which is less than the effective annual interest rate) per...

Study smarter with the SolutionInn App