Belinda Raglan owns a clothing factory. Trading over the last two years has been very successful and

Question:

Belinda Raglan owns a clothing factory. Trading over the last two years has been very successful and she feels that having achieved good results it is now time to request an increase in the overdraft facility.

• In the past the bank has been willing to offer business overdraft facilities and at present there is an agreed limit of £15,000.

• On 1 May 2004 the overdraft stands at £5,000.

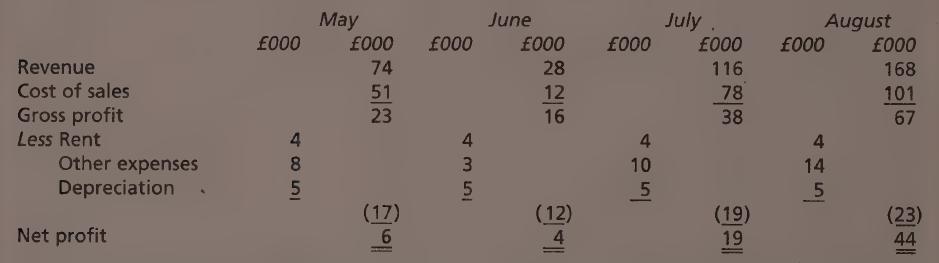

• In order to support her request for the increased facility, she has produced a forecast profit statement for the four months ended 31 August 2004 as follows:

Although Belinda thought these figures would be sufficient to satisfy the requirements of the bank, the manager has asked for a cash budget for the period concerned to be submitted.

The following additional information concerning the business is available.

(1) Rent is paid quarterly in advance on the first day of May, August, November and February.

(2) All other expenses are payable in the month in which they are incurred.

(3) Purchases for the period are expected to be —- May £60,000; June £120,000; July £40,000 and August £43,000. These will be paid for in the month of purchase. Purchases will be unusually high in May and June because they will be subject to a special reduction of 3 per cent of the amounts quoted.

(4) 80 per cent of the sales are on a credit basis payable two months later. Sales in March and April were £88,000 and £84,000 respectively.

(5) A compensation payment of £10,000 to a former employee for an industrial injury, not covered by insurance, is due to be paid in May.

Required:

(a) Prepare a forecast cash budget on a month by month basis for the period May to August 2004.

(b) Discuss the advantages and disadvantages of cash budgeting.

(c) Draft notes, to be used by the bank manager for a letter to Ms Raglan, indicating why the request for an increased overdraft facility may be refused.

(AQA (Associated Examining Board): GCE A-level)

Step by Step Answer:

Business Accounting Uk Gaap Volume 2

ISBN: 9780273718802

1st Edition

Authors: Alan Sangster, Frank Wood