Carlos is a trader buying and selling goods. He does not maintain a full set of double

Question:

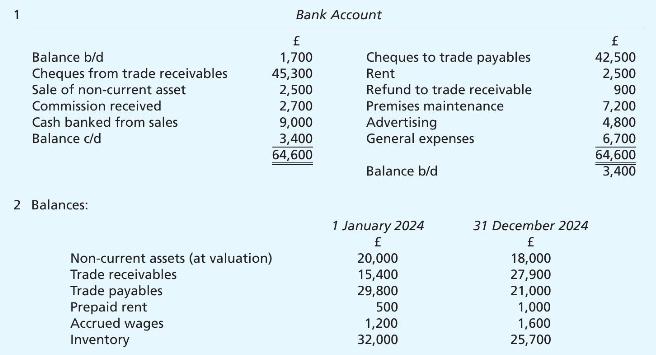

Carlos is a trader buying and selling goods. He does not maintain a full set of double accounting records but has provided the following information at 31 December 2024:

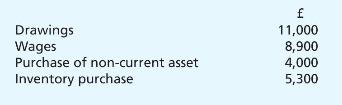

3 During the year ending 31 December 2024, Carlos made the following payments in cash before banking the cash from sales:

\section*{Required:}

(a) Prepare the balance sheet at 1 January 2024 showing the opening capital.

(b) Calculate for the year ended 31 December 2024 the:

(i) revenue for the year (ii) purchases for the year.

(c) Prepare the income statement for the year ended 31 December 2024.

(d) Evaluate Carlos' decision not to maintain a full set of books.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood

Question Posted: