Deflation Ltd, which had experienced trading difficulties, decided to reorganise its finances. On 31 December 2005 a

Question:

Deflation Ltd, which had experienced trading difficulties, decided to reorganise its finances.

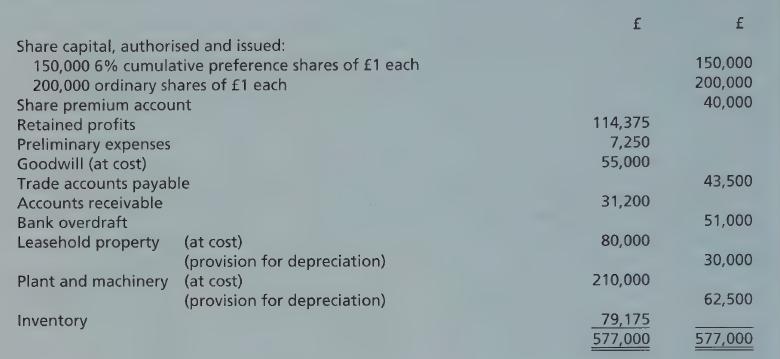

On 31 December 2005 a final trial balance extracted from the books showed the following position:

Approval of the Court was obtained for the following scheme for reduction of capital:

1 The preference shares to be reduced to £0.75 per share.

2 The ordinary shares to be reduced to £0.125 per share.

3 One £0.125 ordinary share to be issued for each £1 of gross preference dividend arrears; the preference dividend had not been paid for three years.

4 The balance on share premium account to be utilised.

5 Plant and machinery to be written down to £75,000.

6 The retained profits, and all intangible assets, to be written off.

At the same time as the resolution to reduce capital was passed, another resolution was approved restoring the total authorised capital to £350,000, consisting of 150,000 6% cumulative preference shares of £0.75 each and the balance in ordinary shares of £0.125 each. As soon as the above resolutions had been passed, 500,000 ordinary shares were issued at par, for cash, payable in full upon application.

You are required:

(a) to show the journal entries necessary to record the above transactions in the company’s books;

and

(b) to prepare a balance sheet of the company, after completion of the scheme.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273712138

11th Edition

Authors: Frank Wood, Alan Sangster