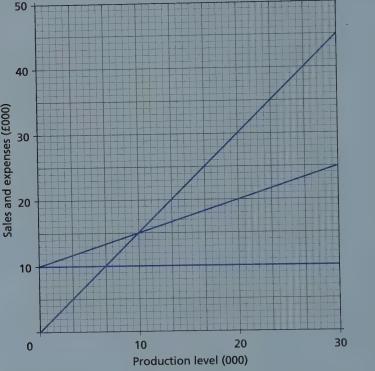

Magwitch Limited's finance director produced the following forecast breakeven chart for the year ending 31 May 2014:

Question:

Magwitch Limited's finance director produced the following forecast breakeven chart for the year ending 31 May 2014:

During the year the company produced and sold 20,000 units, and both revenue and expenses were 10% higher than forecast. Compeyson plc has made an agreed takeover bid for the company at a value of 12 times the net profit for the year ending 31 May 2014. * Magwitch’s assets and liabilities are to be taken over at their statement of financial position values, with the exception of non-current assets, which are to be revalued at £40,000. The summarised statements of financial position of Magwitch Limited and Compeyson plc at the takeover date of 31 May 2014 are as follows: Magwitch Compeyson £000 £000 Non-current assets 32 160 Current assets 65 340 Current liabilities (26) (110) 7 390 Share capital (£1 shares) 40 200 Reserves oi 190 7A 390 The terms of the takeover are that Compeyson plc will give three of its shares (value £1.80 each) for every two shares in Magwitch Limited, plus a cash payment to make up the total agreed takeover price. Magwitch Limited will cease to trade on 31 May 2014, and its assets and liabilities will be assumed by Compeyson plc. Any goodwill arising is to be written-off immediately against reserves.

(a) Draw up a summarised income statement for Magwitch Limited for the year ending 31 May 2014. (6) Draw up a statement of financial position for Compeyson plc after the takeover of Magwitch Limited has taken place.

(c) Calculate how many shares and how much cash would be received by a holder of 6,000 shares in Magwitch Limited as a result of the takeover. (Edexcel: GCE A-level)

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273767923

12th Edition

Authors: Frank Wood, Ph.D. Sangster, Alan