On 30 June 2004 Smith and Sons Ltd acquired all the assets, except the investments, of Firefly

Question:

On 30 June 2004 Smith and Sons Ltd acquired all the assets, except the investments, of Firefly Ltd.

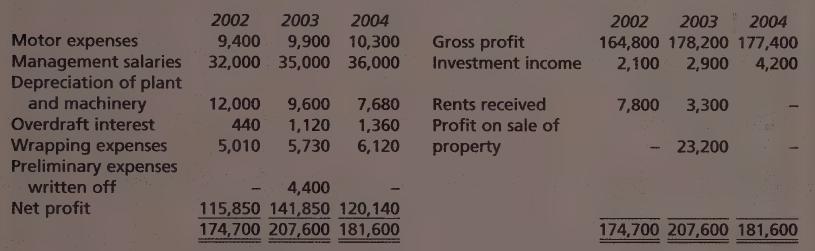

The following are the summaries of the profit and loss account of Firefly Ltd for the years ending 30 June 2002, 2003 and 2004:

The purchase price is to be the amount on which an estimated maintainable profit would represent a return of 20 per cent per annum.

The maintainable profit is to be taken as the average of the profits of the three years 2002, 2003 and 2004, after making any necessary adjustments.

You are given the following information:

(a) The cost of the plant and machinery was £60,000. It has been agreed that depreciation should have been written off at the rate of 10 per cent per annum using the straight line method.

(b) A new type of wrapping material means that wrapping expenses will be halved in future. _

(c) By switching to a contract supply basis on motor fuel and motor repairs, it is estimated that motor expenses will fall by 25 per cent in future.

(d) Stock treated as valueless at 30 June 2001 was sold for £4,700 in 2003.

(e) The working capital of the new company is sound and it is felt that there will be no need for a bank overdraft in the foreseeable future.

(f) Management salaries have been inadequate and will have to be increased by £35,000 a year in future.

You are required to set out your calculation of the purchase price. All workings must be shown.

In fact, your managing director, who is not an accountant, should be able to decipher how the price was calculated.

Step by Step Answer:

Business Accounting Uk Gaap Volume 2

ISBN: 9780273718802

1st Edition

Authors: Alan Sangster, Frank Wood