Deal Ltd was incorporated on 1 September 2004 and took over the business of Fish and Chip

Question:

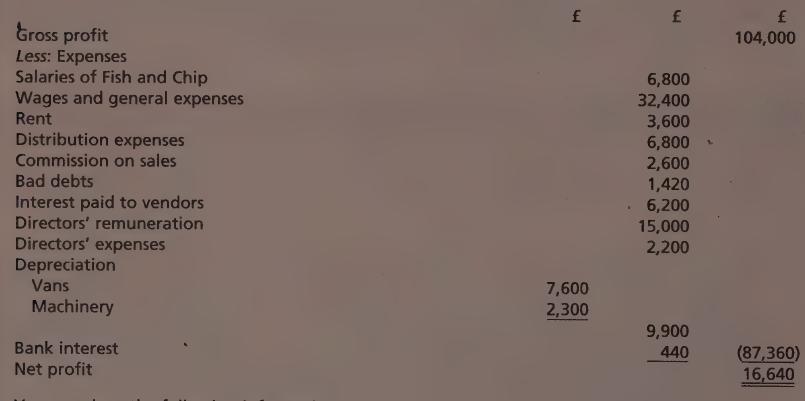

Deal Ltd was incorporated on 1 September 2004 and took over the business of Fish and Chip on 1 June 2004. It was agreed that all profits made from 1 June should belong to the company and that the vendors should be entitled to interest on the purchase price from 1 June to the date of payment. The purchase price was paid on 31 October 2004 including £3,300 interest. ae The following is the profit and loss account for the year ending 31 May 2005:

You are given the following information:

1. Sales amounted to £72,000 for the three months to 31 August 2004 and £132,000 for the nine months to 31 May 2005. Gross profit is at a uniform rate of 50 per cent of selling price throughout the year, and commission at a rate of 1 per cent is paid on all sales.

2. Salaries of £6,800 were paid to the partners for their assistance in running the business up to31 August 2004.

3. The bad debts written-off are:

(a) a debt of £480 taken over from the vendors;

(b) a debt of £940 in respect of goods sold in November 2004.

4. On 1 June 2004, two vans were bought for £28,000 and machinery for £20,000. On 1 August 2004 another van was bought for £12,000 and on 1 March 2005, another machine was added for £12,000.

Depreciation has been written off vans at 20 per cent per annum, and machinery 10 per cent per annum. Depreciation is written off for each month in which an asset is owned.

5. Wages and general expenses and rent all accrued at an even rate throughout the year.

6. The bank granted an overdraft facility in September 2004.

Assuming all calendar months are of equal length:

(a) set out the profit and loss account in columnar form, so as to distinguish between the period prior to the company’s incorporation and the period after incorporation;

(b) state how you would deal with the profit prior to incorporation;

(c) state how you would deal with the results prior to incorporation if they had turned out to be a net loss.

Step by Step Answer:

Business Accounting Uk Gaap Volume 2

ISBN: 9780273718802

1st Edition

Authors: Alan Sangster, Frank Wood