Checkers Ltd was incorporated on 1 April 19X5 and took over the business of Black and White,

Question:

Checkers Ltd was incorporated on 1 April 19X5 and took over the business of Black and White, partners, as from 1 January 19 X5. It was agreed that all profits made from 1 January should belong to the company and that the vendors should be entitled to interest on the purchase price from 1 January to date of payment. The purchase price was paid on 31 May 19X5 including \(£ 1,650\) interest.

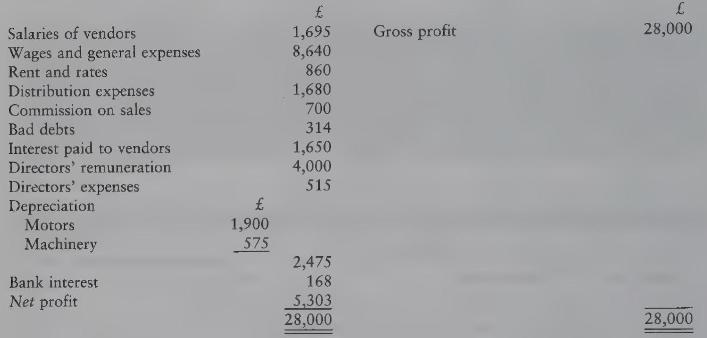

The following is the profit and loss account for the year to 31 December 19X5:

You are given the following information:

1 Sales amounted to \(£ 20,000\) for the three months to 31 March 19 X 5 and \(£ 50,000\) for the nine months to 31 December 19X5. Gross profit is at a uniform rate of 40 per cent of selling price throughout the year, and commission at a rate of 1 per cent is paid on all sales.

2 Salaries of \(£ 1,695\) were paid to the vendors for their assistance in running the business up to 31 March 19 X 5.

3 The bad debts written off are:

(a) a debt of \(£ 104\) taken over from the vendors;

(b) a debt of \(£ 210\) in respect of goods sold in August 19X5.

4 On 1 January 19X5 motors were bought for \(£ 7,000\) and machinery for \(£ 5,000\). On 1 March 19X5 another motor van was bought for \(£ 3,000\) and on 1 October 19 X 5 another machine was added for \(£ 3,000\). Depreciation has been written off motors at 20 per cent per annum, and machinery 10 per cent per annum.

5 Wages and general expenses and rent and rates accrued at an even rate throughout the year.

6 The bank granted an overdraft in June 19X5.

Assuming all calendar months are of equal length:

(a) set out the profit and loss account in columnar form, so as to distinguish between the period prior to the company's incorporation and the period after incorporation;

(b) state how you would deal with the profit prior to incorporation;

(c) state how you would deal with the results prior to incorporation if they turned out to be a net loss.

Step by Step Answer: